Question: Problem 25 Intro Lumber Corp's common stock trades at a price of $35.36 per share. The most recent dividend was $1.12 per share and it

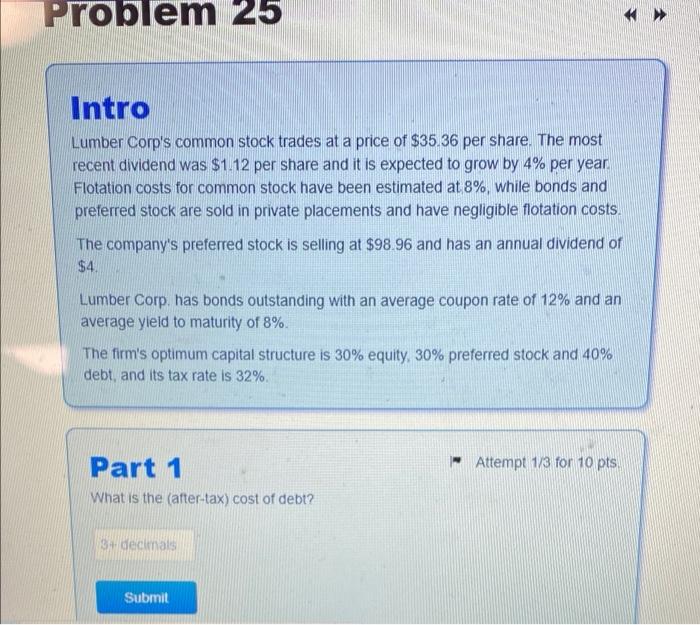

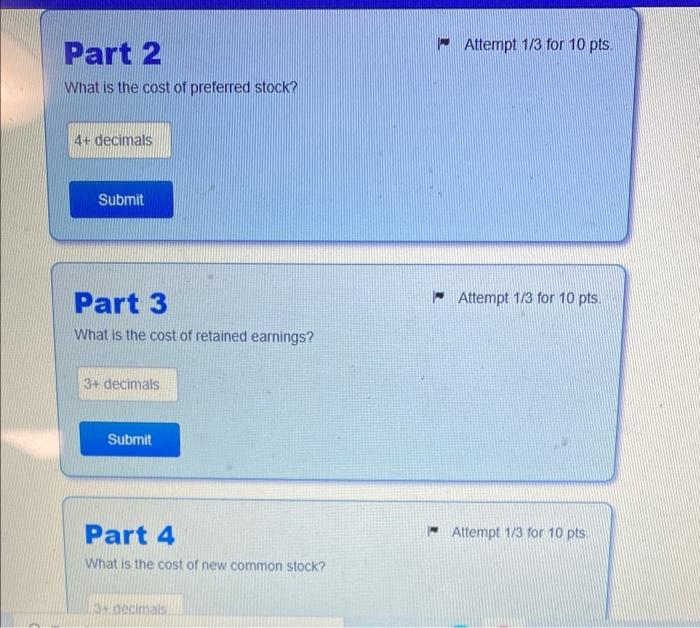

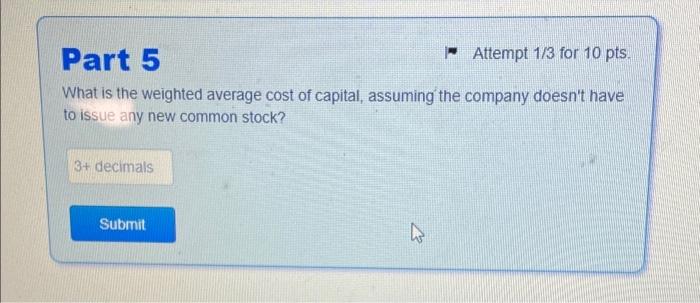

Problem 25 Intro Lumber Corp's common stock trades at a price of $35.36 per share. The most recent dividend was $1.12 per share and it is expected to grow by 4% per year Flotation costs for common stock have been estimated at 8%, while bonds and preferred stock are sold in private placements and have negligible flotation costs. The company's preferred stock is selling at $98.96 and has an annual dividend of $4. Lumber Corp. has bonds outstanding with an average coupon rate of 12% and an average yield to maturity of 8%. The firm's optimum capital structure is 30% equity, 30% preferred stock and 40% debt and its tax rate is 32% Attempt 1/3 for 10 pts Part 1 What is the (after-tax) cost of debt? decimals Submit - Attempt 1/3 for 10 pts. Part 2 What is the cost of preferred stock? 4+ decimals Submit Attempt 1/3 for 10 pts Part 3 What is the cost of retained earnings? 3+ decimals Submit Attempt 1/3 for 10 pts Part 4 What is the cost of new common stock? decimals Part 5 Attempt 1/3 for 10 pts. What is the weighted average cost of capital, assuming the company doesn't have to issue any new common stock? 3+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts