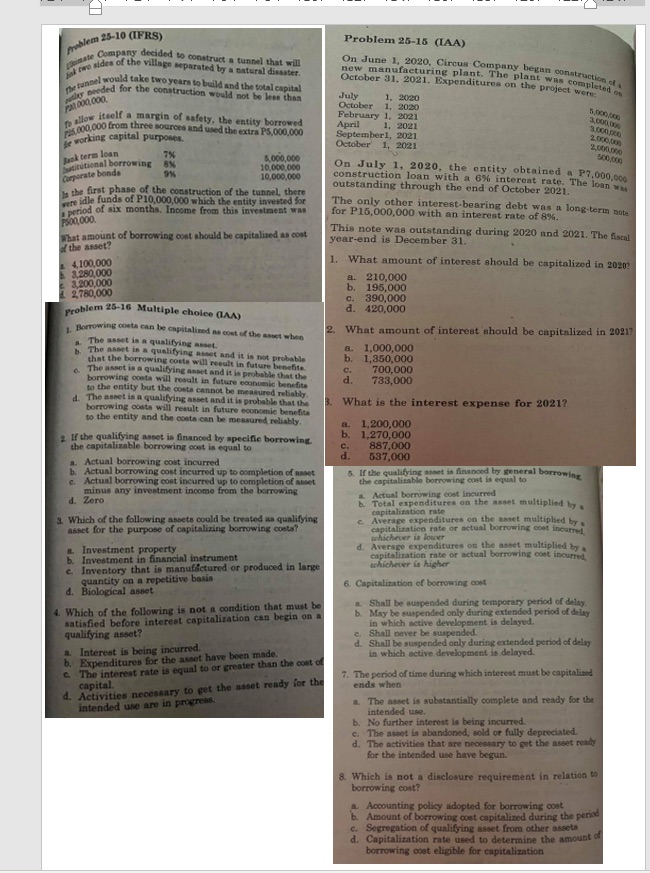

Question: Problem 25-10 (IFRS) Problem 25-15 (LAA) caste Company decided to construct a tunnel that will be rare sides of the village separated by a natural

Problem 25-10 (IFRS) Problem 25-15 (LAA) caste Company decided to construct a tunnel that will be rare sides of the village separated by a natural disaster. On June 1, 2020, Circus Company began construction of tunnel would take two years to build and the total capital new manufacturing plant. The plant was completed or October 31, 2021. Expenditures on the project were: July 20 090,000. Bjay seeded for the construction would not be less than 1, 2020 October 1, 2020 to allow itself a margin of safety, the entity borrowed February 1, 2021 :5000,000 from three sources and used the extra P5,000,090 April 2021 be working capital purposes. September1, 2021 3,000,000 October 1, 2021 2,00060 2,000.060 Back term loan TN 5,000,000 500,000 butitutional borrowing 10.000,000 Corporate bonds On July 1, 2020, the entity obtained a P7,000,90g 10,000.000 construction loan with a 6%% interest rate. The loan way Is the first phase of the construction of the tunnel, there outstanding through the end of October 2021. were idle funds of P10,000,000 which the entity invested for period of six months, Income from this investment was The only other interest-bearing debt was a long-term note F500,000. for P15,000,000 with an interest rate of 8%. What amount of borrowing cost should be capitalized as cost This note was outstanding during 2020 and 2021. The fiscal of the asset? year-end is December 31. 4.100,000 1. What amount of interest should be capitalized in 2020? 3.280,000 A. 210,000 3,200,000 b. 195,000 2780,000 C. 390,000 problem 25-16 Multiple choice (LAA) 420,000 1. Borrowing costs can be capitalized as cost of the sanct when What amount of interest should be capitalized in 2021? The asset is a qualifying asset. b. The ameet in a qualifying asset and it is not probable a. 1,000,000 that the borrowing costs will result in future benefits. b. 1,850,000 The asset is a qualifying asset and it is probable that the C. 700,000 borrowing costs will result in future economic benefits 733,000 to the entity but the costa cannot be measured reliably d The asset is a qualifying asset and it is probable that the borrowing costs will result in future economic benefits What is the interest expense for 2021? to the entity and the coats ca be measured reliably. 1,200,000 If the qualifying asset is financed by specific borrowing b. 1,270,000 the capitalizable borrowing cost is equal to 887,000 Actual borrowing cost incurred 537,000 b. Actual borrowing cost incurred up to completion of net 5. If the qualifying asset is financed by general borrowing e. Actual borrowing cost incurred up to completion of sweet the capitalizable borrowing cost is equal to minus any investment income from the borrowing Actual borrowing cost incurred Zero b. Total expenditures on the asset multiplied by a capitalization rate 3. Which of the following assets could be treated as qualifying Average expenditures on the asset multiplied by a asset for the purpose of capitalizing borrowing costs? capitalization rate or actual borrowing cost incurred Investment property d. Average expenditures on the asset multiplied by a b. Investment in financial instrument capitalization rate or actual borrowing cost incurred . Inventory that is manufactured or produced in large whichever is higher quantity on a repetitive basis 6. Capitalization of borrowing coat Biological asset 4. Which of the following is not a condition that must be Shall be suspended during temporary period of delay. b. May be suspended only during extended period of delay satisfied before interest capitalization can begin on a in which active development is delayed. qualifying asset? Shall never be suspended. d. Shall be suspended only during extended period of delay Interest is being incurred. b. Expenditures for the asset have been made. in which active development is delayed. The interest rate is equal to or greater than the cost of 7. The period of time during which interest must be capitalized capital. d. Activities necessary to get the asset ready for the ends when intended use are in progress. The asset is substantially complete and ready for the intended use. b. No further interest is being incurred. c. The asset is abandoned, sold or fully depreciated. d. The activities that are necessary to get the asset ready for the intended use have begun. 8. Which is not a disclosure requirement in relation to borrowing cost? a. Accounting policy adopted for borrowing cost . Amount of borrowing cost capitalized during the period Segregation of qualifying asset from other assets d. Capitalization rate used to determine the amount of borrowing cost eligible for capitalization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts