Question: Problem 25-27 Convertible Bonds and Value of Implicit Call Option (L04) A 9-year maturity convertible bond with a 4% annual coupon on a company with

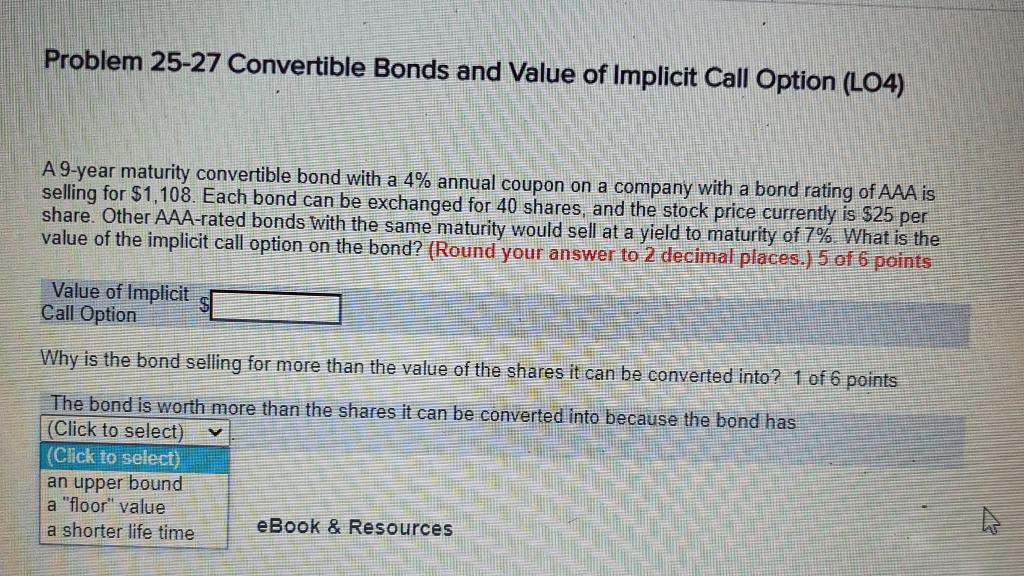

Problem 25-27 Convertible Bonds and Value of Implicit Call Option (L04) A 9-year maturity convertible bond with a 4% annual coupon on a company with a bond rating of AAA is selling for $1,108. Each bond can be exchanged for 40 shares, and the stock price currently is $25 per share. Other AAA-rated bonds with the same maturity would sell at a yield to maturity of 7% What is the value of the implicit call option on the bond? (Round your answer to 2 decimal places.) 5 of 6 points Value of Implicit Call Option Why is the bond selling for more than the value of the shares it can be converted into? 1 of 6 points The bond is worth more than the shares it can be converted into because the bond has (Click to select) (Click to select) an upper bound a "floor" value a shorter life time eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts