Question: Problem 2-6 Journal entries and statement preparation (LO2-12) Bob's Chocolate Chips and More, a bakery specializing in gourmet pizza and chocolate chip cookies, started business

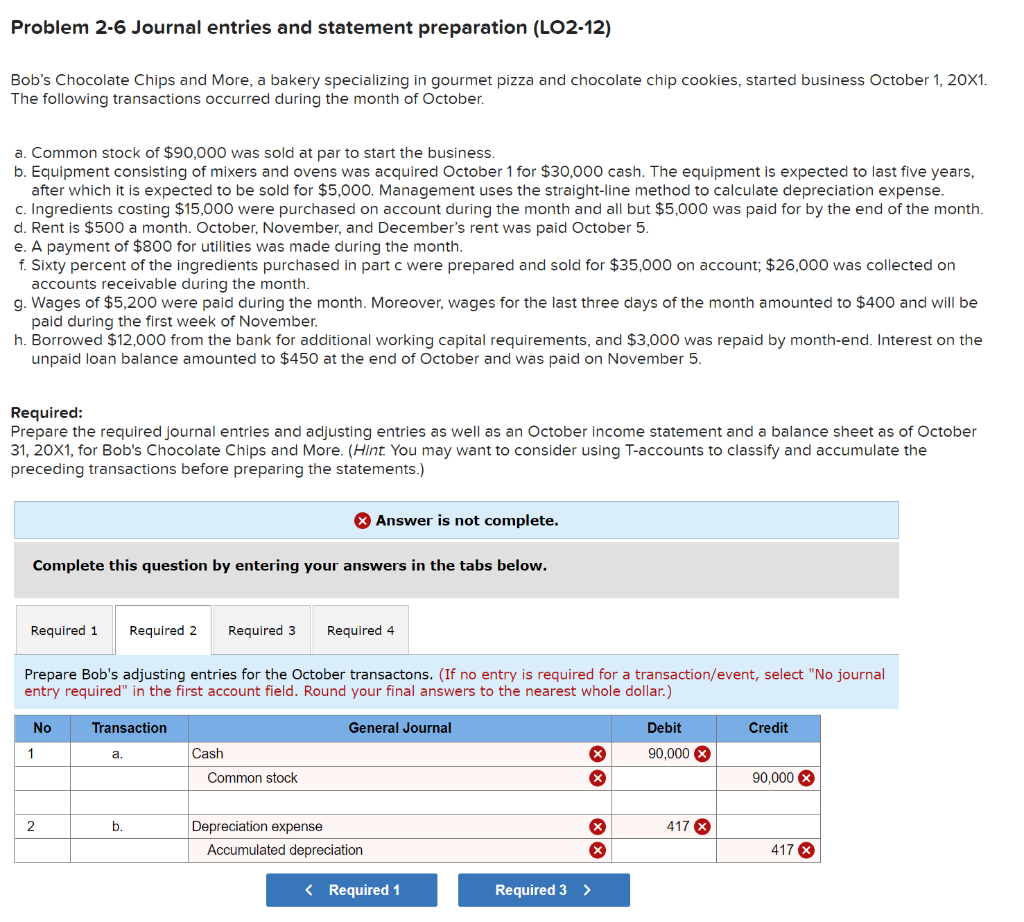

Problem 2-6 Journal entries and statement preparation (LO2-12) Bob's Chocolate Chips and More, a bakery specializing in gourmet pizza and chocolate chip cookies, started business October 1, 20X1. The following transactions occurred during the month of October. a. Common stock of $90,000 was sold at par to start the business. b. Equipment consisting of mixers and ovens was acquired October 1 for $30,000 cash. The equipment is expected to last five years, after which it is expected to be sold for $5,000. Management uses the straight-line method to calculate depreciation expense. c. Ingredients costing $15,000 were purchased on account during the month and all but $5,000 was paid for by the end of the month. d. Rent is $500 a month. October, November, and December's rent was paid October 5. e. A payment of $800 for utilities was made during the month. f. Sixty percent of the ingredients purchased in part c were prepared and sold for $35,000 on account: $26,000 was collected on accounts receivable during the month. g. Wages of $5,200 were paid during the month. Moreover, wages for the last three days of the month amounted to $400 and will be paid during the first week of November. h. Borrowed $12,000 from the bank for additional working capital requirements, and $3,000 was repaid by month-end. Interest on the unpaid loan balance amounted to $450 at the end of October and was paid on November 5. Required: Prepare the required journal entries and adjusting entries as well as an October income statement and a balance sheet as of October 31, 20X1, for Bob's Chocolate Chips and More. (Hint You may want to consider using T-accounts to classify and accumulate the preceding transactions before preparing the statements.) Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Prepare Bob's adjusting entries for the October transactons. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar.) No Transaction General Journal Debit Credit 1 a. Cash 90,000 X X x Common stock 90,000 X 2 b. x 417 X Depreciation expense Accumulated depreciation 417 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts