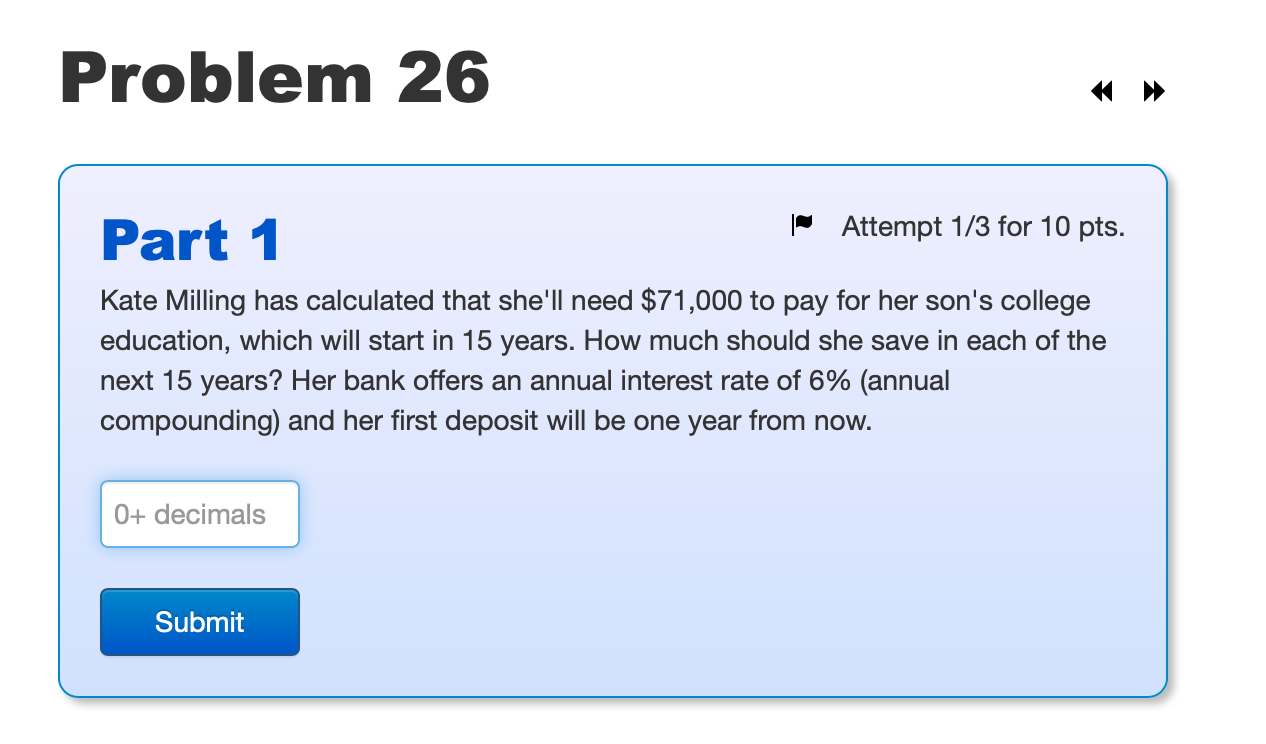

Question: Problem 26 Part 1 | Attempt 1/3 for 10 pts. Kate Milling has calculated that she'll need $71,000 to pay for her son's college education,

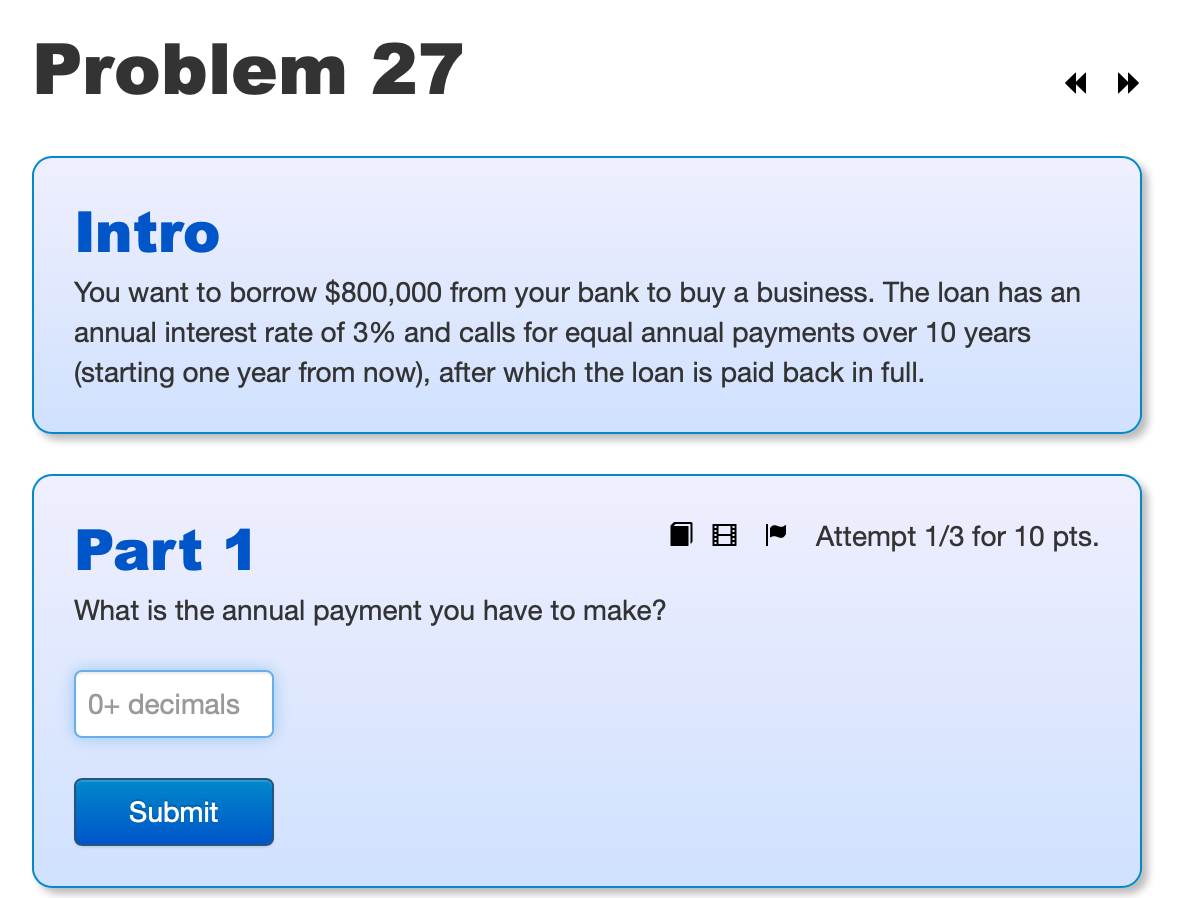

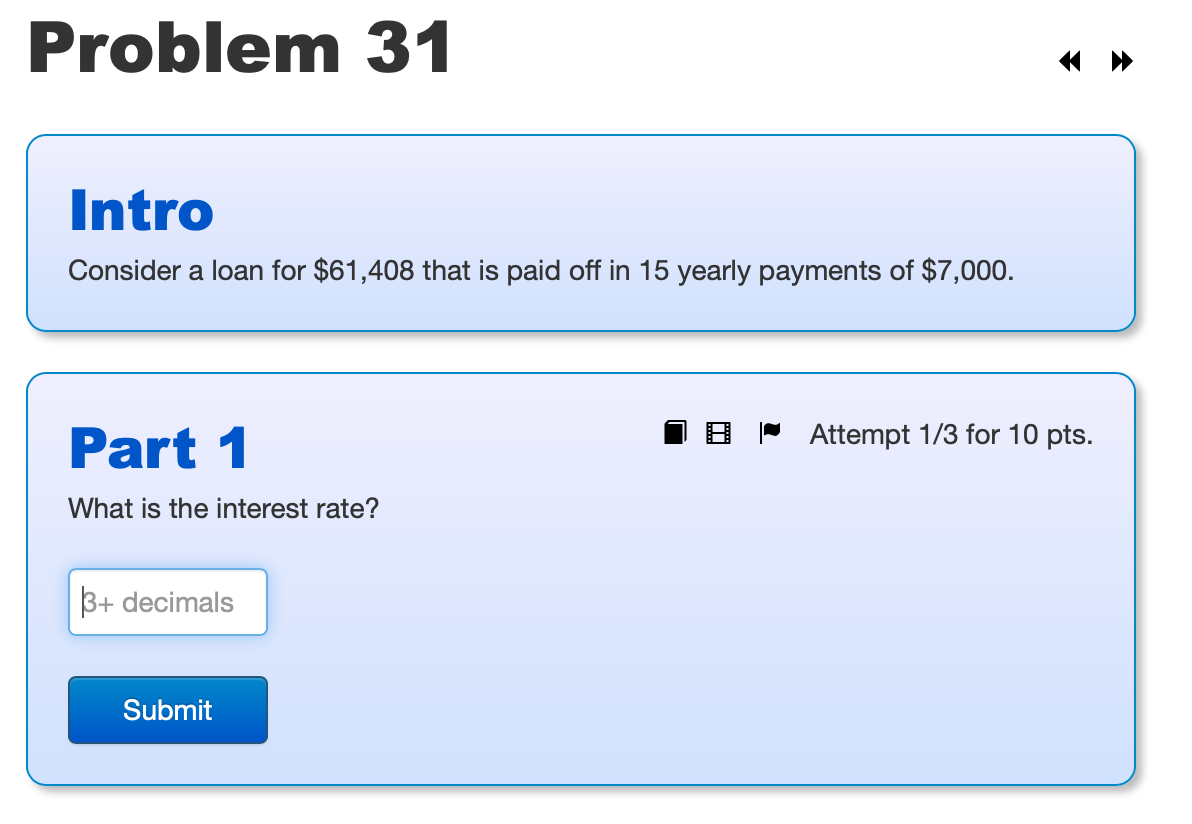

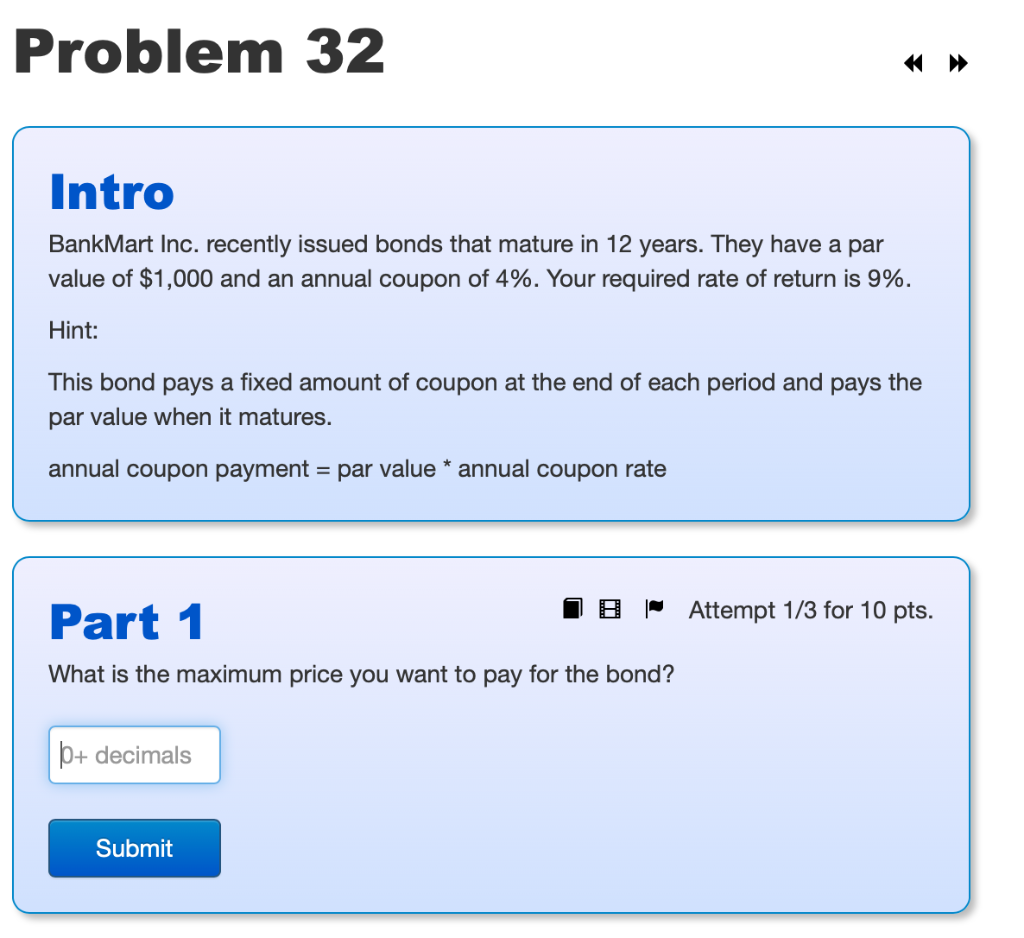

Problem 26 Part 1 | Attempt 1/3 for 10 pts. Kate Milling has calculated that she'll need $71,000 to pay for her son's college education, which will start in 15 years. How much should she save in each of the next 15 years? Her bank offers an annual interest rate of 6% (annual compounding) and her first deposit will be one year from now. 0+ decimals Submit Problem 27 Intro You want to borrow $800,000 from your bank to buy a business. The loan has an annual interest rate of 3% and calls for equal annual payments over 10 years (starting one year from now), after which the loan is paid back in full. Attempt 1/3 for 10 pts. Part 1 What is the annual payment you have to make? 0+ decimals Submit Problem 31 Intro Consider a loan for $61,408 that is paid off in 15 yearly payments of $7,000. Part 1 Attempt 1/3 for 10 pts. What is the interest rate? $+ decimals Submit Problem 32 Intro BankMart Inc. recently issued bonds that mature in 12 years. They have a par value of $1,000 and an annual coupon of 4%. Your required rate of return is 9%. Hint: This bond pays a fixed amount of coupon at the end of each period and pays the par value when it matures. annual coupon payment = par value * annual coupon rate Part 1 | Attempt 1/3 for 10 pts. What is the maximum price you want to pay for the bond? + decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts