Question: PROBLEM 26.5A Capital Budgeting Using Multiple Models LO26-1, LO26-2, LO26-3, LO26-4 V. S. Yogurt is considering two possible expansion plans. Proposal A involves opening

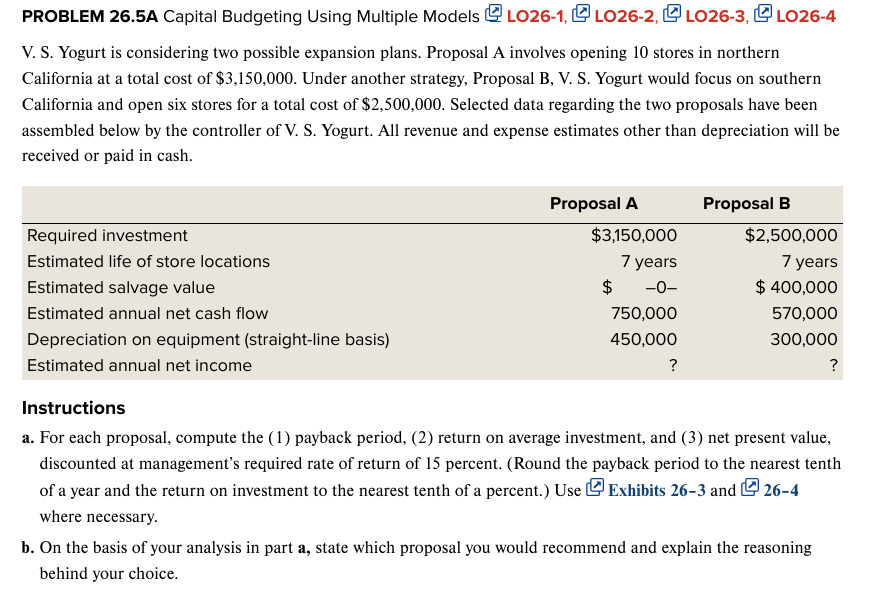

PROBLEM 26.5A Capital Budgeting Using Multiple Models LO26-1, LO26-2, LO26-3, LO26-4 V. S. Yogurt is considering two possible expansion plans. Proposal A involves opening 10 stores in northern California at a total cost of $3,150,000. Under another strategy, Proposal B, V. S. Yogurt would focus on southern California and open six stores for a total cost of $2,500,000. Selected data regarding the two proposals have been assembled below by the controller of V. S. Yogurt. All revenue and expense estimates other than depreciation will be received or paid in cash. Required investment Proposal A $3,150,000 Estimated life of store locations 7 years Proposal B $2,500,000 7 years Estimated salvage value $ -0- $ 400,000 Estimated annual net cash flow 750,000 570,000 Depreciation on equipment (straight-line basis) 450,000 300,000 Estimated annual net income ? ? Instructions a. For each proposal, compute the (1) payback period, (2) return on average investment, and (3) net present value, discounted at management's required rate of return of 15 percent. (Round the payback period to the nearest tenth of a year and the return on investment to the nearest tenth of a percent.) Use where necessary. Exhibits 26-3 and 26-4 b. On the basis of your analysis in part a, state which proposal you would recommend and explain the reasoning behind your choice.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts