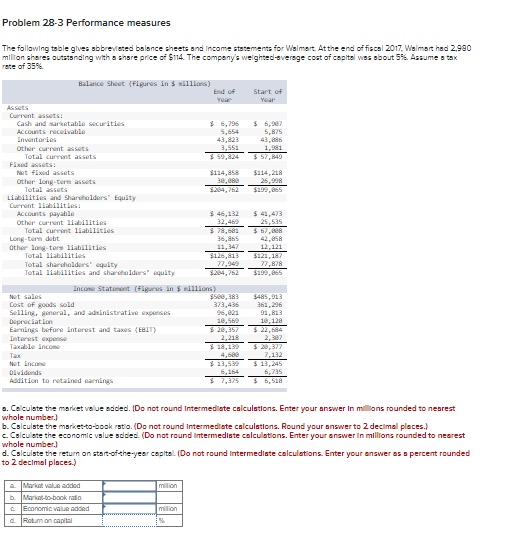

Question: Problem 28-3 Performance measures 5,875 The following table gives abbreviated balance sheets and Income statements for Walmart. At the end of fiscal 2017, Walmart had

Problem 28-3 Performance measures 5,875 The following table gives abbreviated balance sheets and Income statements for Walmart. At the end of fiscal 2017, Walmart had 2,990 million shares outstanding with a share price of $114. The company's weighted average cost of capitales about 55. Assume a tax rate of 35% Balance Sheet (Figures in Sellions) End of Start of Year Assets Current assets: Cash and marketable securities $ 5,97 Accounts receivable 5,654 Inventories 43,823 Other current assets 3,551 Total current assets $ 59,34 Fixed assets: Net fixed assets $114,850 $114,218 Other long-term assets 30,00 25,900 Total assets $204,712 $199.865 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $ 46,112 $ 41,473 Other current abilities 25,535 Total current liabilities $78,50 $ 57,00 Long-term debit 36,5 other long to liabilities 12,121 Total liabilities $126,813 $121,182 Total shareholders' quity 77,949 77.78 Total liabilities and shareholders equity $199,265 Income Statement (Figures in $ millions) Net sales $50,33 5485,913 Cost of goods sold 373,435 361,296 Selling general, and adninistrative expenses 96,023 91.13 Depreciation 18,569 18, 128 Earnings before interest and taxes (EBIT) $ 20,357 $ 22,684 Interest espor 2.218 Taxable income $ 18,19 328,377 Tax 7,112 Net Income $ 13,539 Dividends 6,235 Addition to retained earnings $7.15 $6,512 2.32 4,6 a. Calculate the market value added. Do not round Intermediate calculations. Enter your answer in millions rounded to nearest whole number.) b. Calculste the market to book rsto. Do not round Intermediate calculations. Round your answer to 2 decimal places. c. Calculate the economic value added (Do not round Intermediate calculations. Enter your answer in millions rounded to nearest whole number.) d. Calculste the return on start-of-the-year capital. (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) million a Maria va added b. Markut-to-book ratio c Economic value added d. Return on capital milion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts