Question: Problem 2.a. Consider a 30-year maturity bond with an 8% coupon with a $1,000 face value. Suppose the yield curve is a flat 8% for

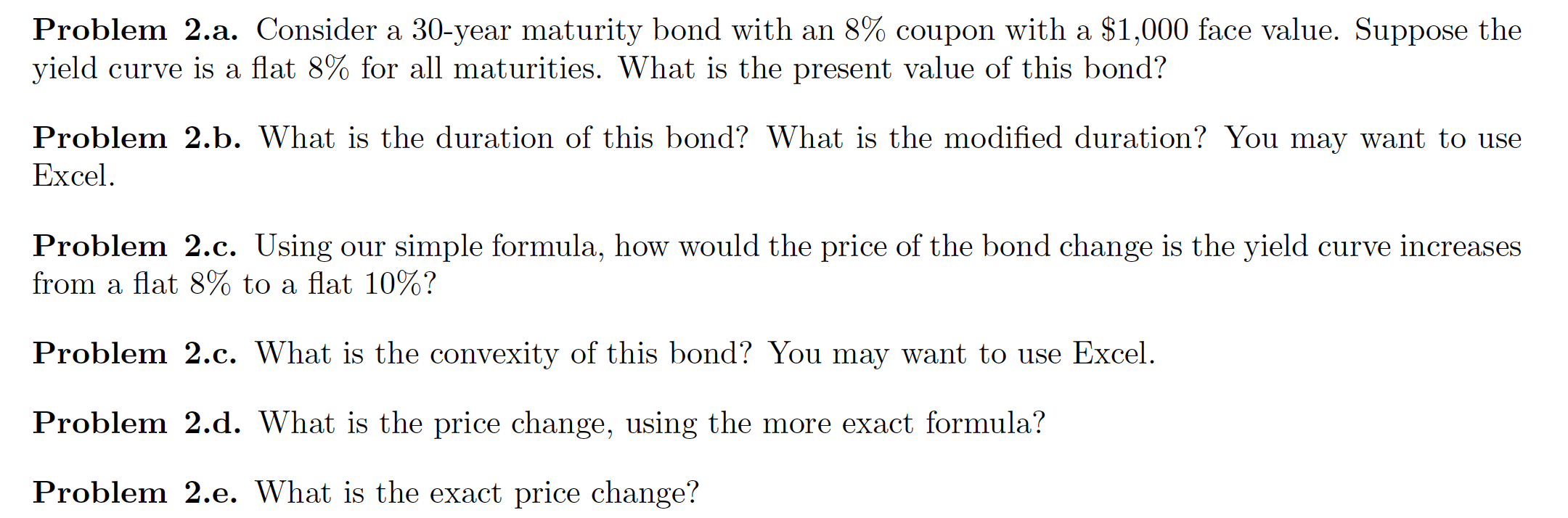

Problem 2.a. Consider a 30-year maturity bond with an 8% coupon with a $1,000 face value. Suppose the yield curve is a flat 8% for all maturities. What is the present value of this bond? Problem 2.b. What is the duration of this bond? What is the modified duration? You may want to use Excel. Problem 2.c. Using our simple formula, how would the price of the bond change is the yield curve increases from a flat 8% to a flat 10%? Problem 2.c. What is the convexity of this bond? You may want to use Excel. Problem 2.d. What is the price change, using the more exact formula? Problem 2.e. What is the exact price change

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock