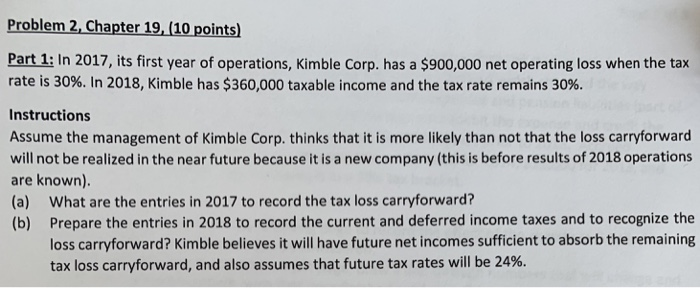

Question: Problem 2.Chapter 19,(10 points) Part 1: In 2017, its first year of operations, Kimble Corp. has a $900,000 net operating loss when the tax rate

Problem 2.Chapter 19,(10 points) Part 1: In 2017, its first year of operations, Kimble Corp. has a $900,000 net operating loss when the tax rate is 30%. In 2018, Kimble has $360,000 taxable income and the tax rate remains 30%. Instructions Assume the management of Kimble Corp. thinks that it is more likely than not that the loss carryforward will not be realized in the near future because it is a new company (this is before results of 2018 operations are known). (a) What are the entries in 2017 to record the tax loss carryforward? (b) Prepare the entries in 2018 to record the current and deferred income taxes and to recognize the loss carryforward? Kimble believes it will have future net incomes sufficient to absorb the remaining tax loss carryforward, and also assumes that future tax rates will be 24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts