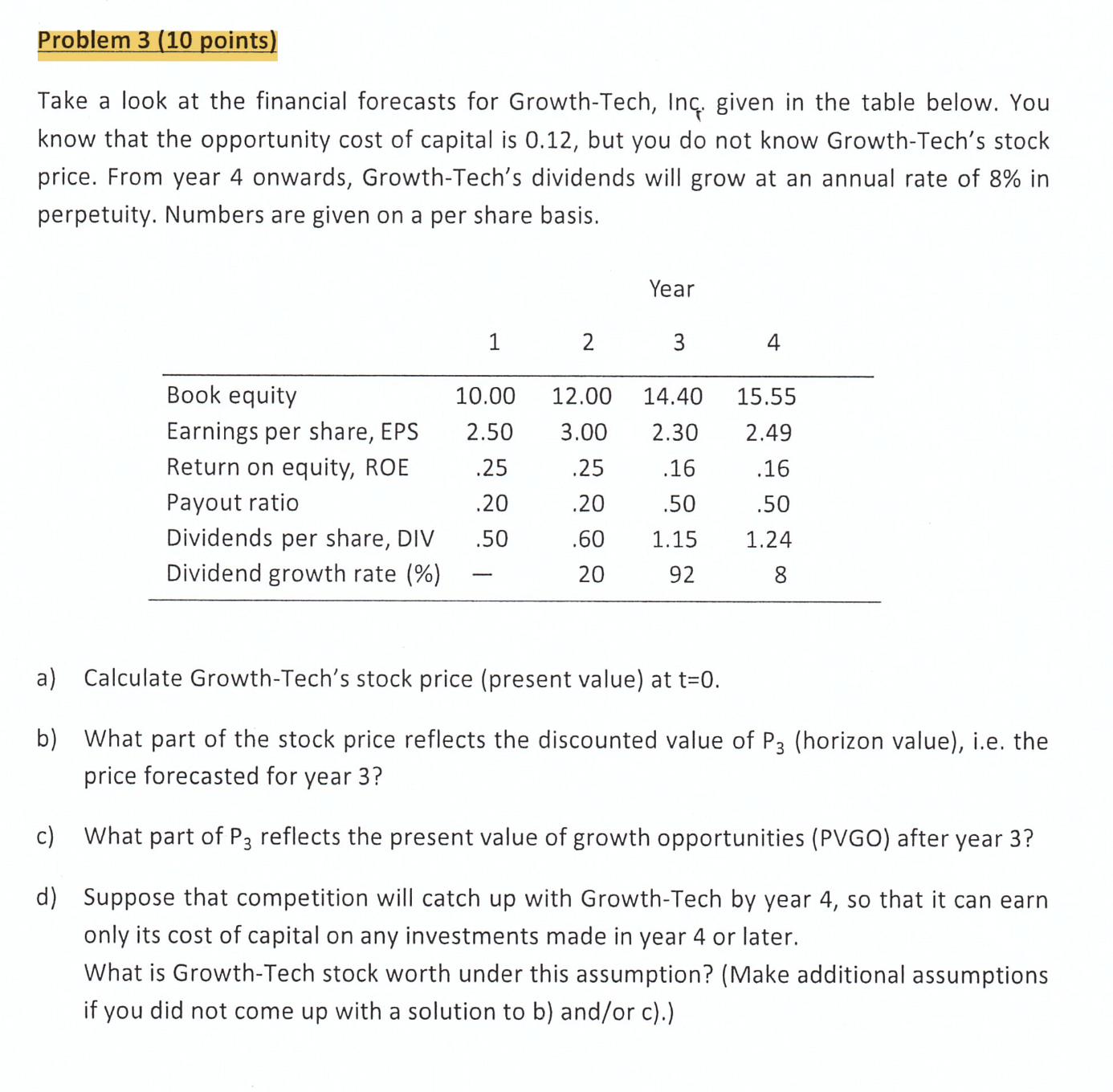

Question: Problem 3 ( 1 0 points ) Take a look at the financial forecasts for Growth - Tech, Inc. given in the table below. You

Problem points Take a look at the financial forecasts for GrowthTech, Inc. given in the table below. You know that the opportunity cost of capital is but you do not know GrowthTech's stock price. From year onwards, GrowthTech's dividends will grow at an annual rate of in perpetuity. Numbers are given on a per share basis. a Calculate GrowthTech's stock price present value at mathrmt b What part of the stock price reflects the discounted value of Phorizon value ie the price forecasted for year c What part of P reflects the present value of growth opportunities PVGO after year d Suppose that competition will catch up with GrowthTech by year so that it can earn only its cost of capital on any investments made in year or later. What is GrowthTech stock worth under this assumption? Make additional assumptions if you did not come up with a solution to b andor c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock