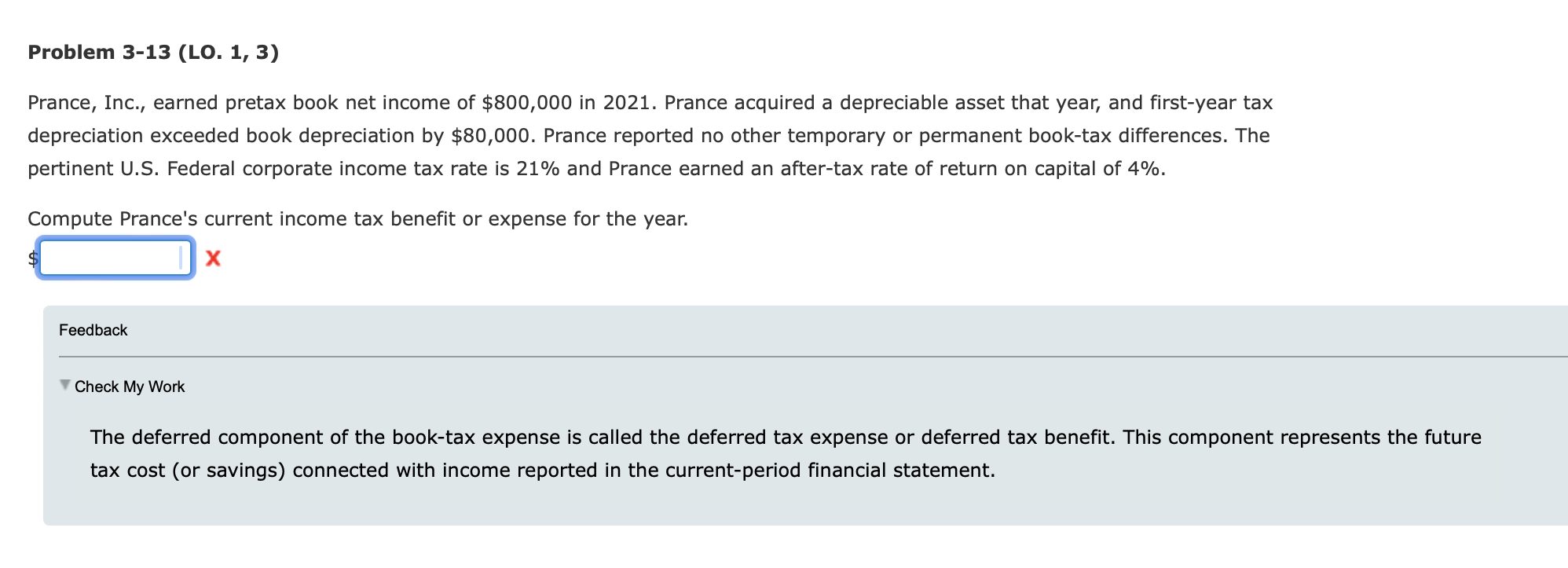

Question: Problem 3 - 1 3 ( LO . 1 , 3 ) Prance, Inc., earned pretax book net income of $ 8 0 0 ,

Problem LO

Prance, Inc., earned pretax book net income of $ in Prance acquired a depreciable asset that year, and firstyear tax

depreciation exceeded book depreciation by $ Prance reported no other temporary or permanent booktax differences. The

pertinent US Federal corporate income tax rate is and Prance earned an aftertax rate of return on capital of

Compute Prance's current income tax benefit or expense for the year.

Feedback

Check My Work

The deferred component of the booktax expense is called the deferred tax expense or deferred tax benefit. This component represents the future

tax cost or savings connected with income reported in the currentperiod financial statement.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock