Question: Problem 3 - 1 3 Meals And Entertainment ( LO 3 . 5 ) Marty is a sales consultant. Marty incurs the following expenses related

Problem

Meals And Entertainment LO

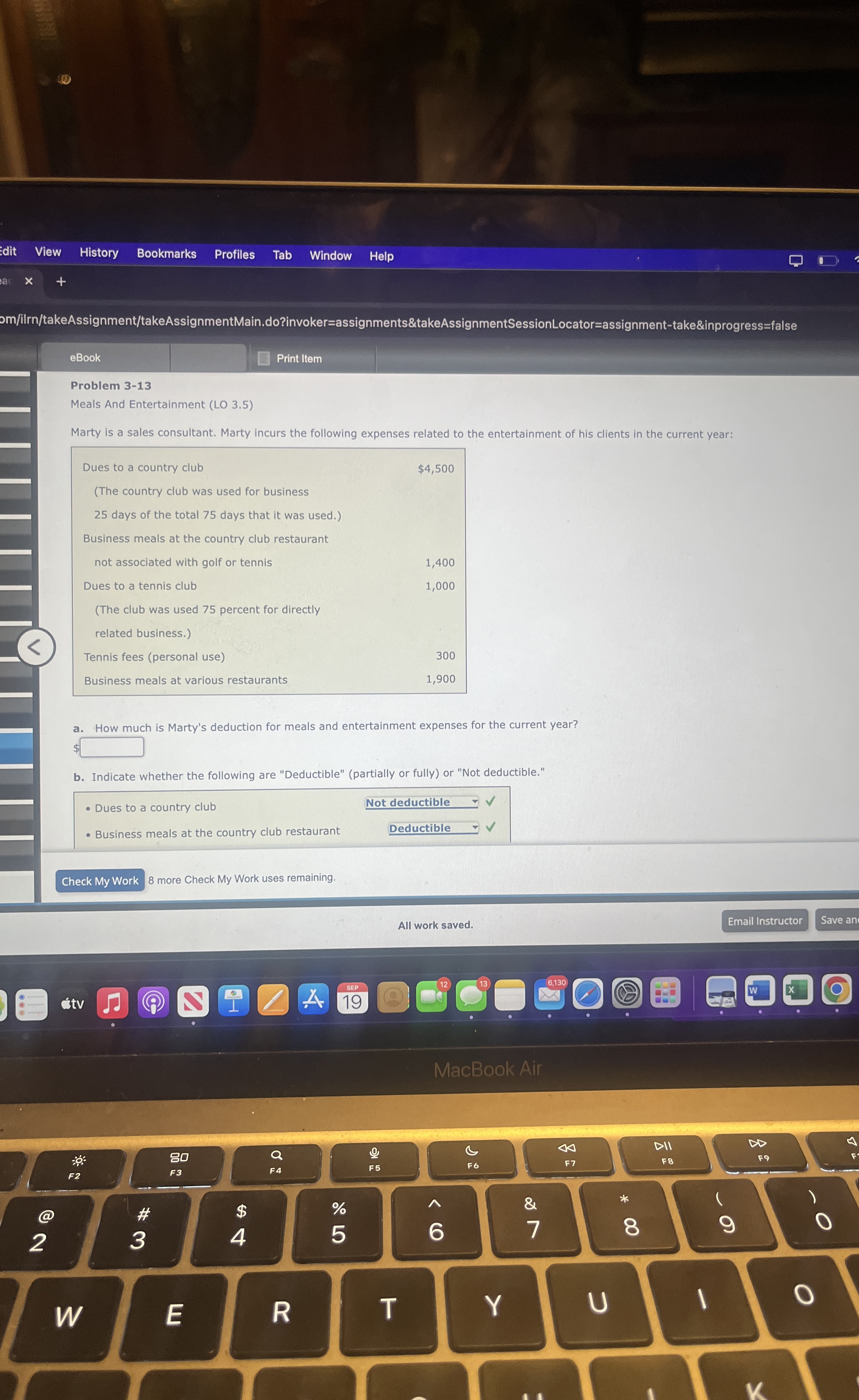

Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in the current year:

Dues to a country club

The country club was used for business

days of the total days that it was used.

Business meals at the country club restaurant

not associated with golf or tennis

Dues to a tennis club

The club was used percent for directly

related business.

Tennis fees personal use

Business meals at various restaurants

a How much is Marty's deduction for meals and entertainment expenses for the current year?

b Indicate whether the following are "Deductible" partially or fully or "Not deductible."

Dues to a country club

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock