Question: Problem 3 ( 1 point ) A company needs funds and its banking institution offers the following alternatives: - Option A: line of credit with

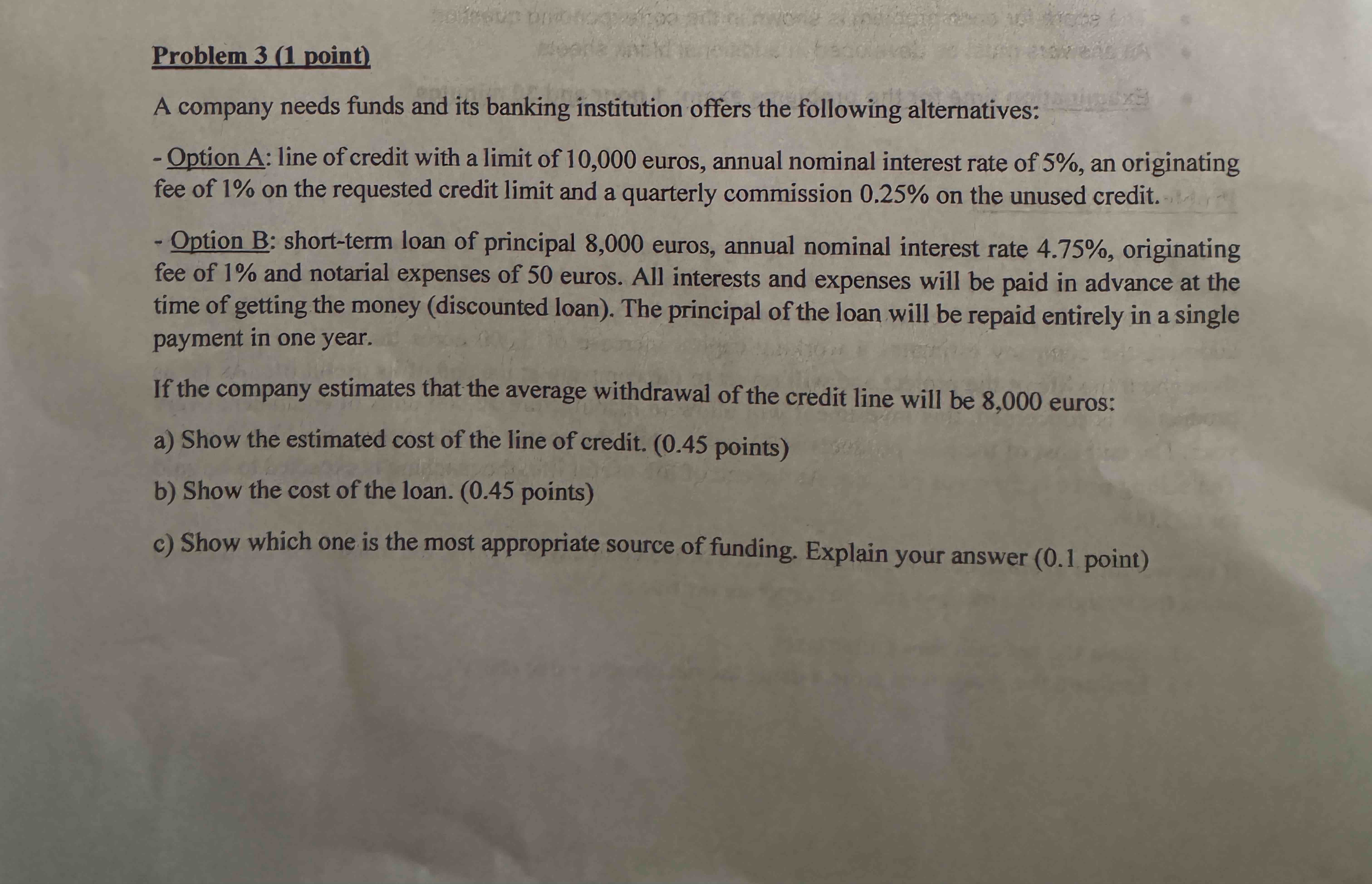

Problem point A company needs funds and its banking institution offers the following alternatives: Option A: line of credit with a limit of euros, annual nominal interest rate of an originating fee of on the requested credit limit and a quarterly commission on the unused credit. Option B: shortterm loan of principal euros, annual nominal interest rate originating fee of and notarial expenses of euros. All interests and expenses will be paid in advance at the time of getting the money discounted loan The principal of the loan will be repaid entirely in a single payment in one year. If the company estimates that the average withdrawal of the credit line will be euros: a Show the estimated cost of the line of credit. points b Show the cost of the loan. points c Show which one is the most appropriate source of funding. Explain your answer point

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock