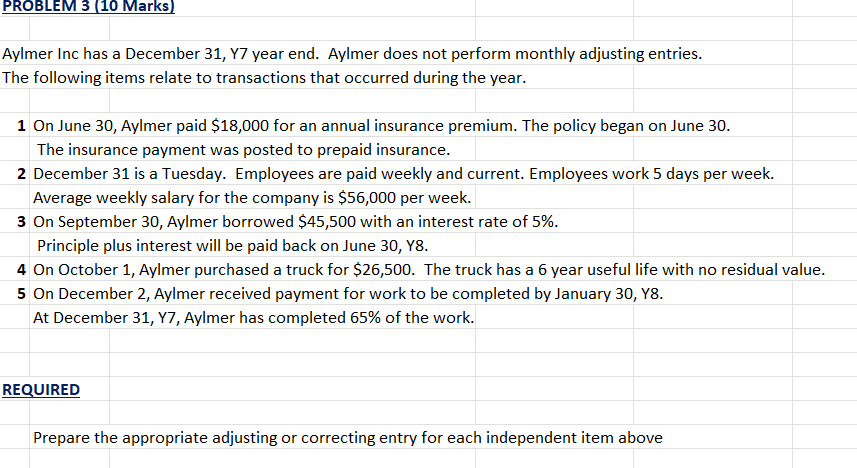

Question: PROBLEM 3 (10 Marks) Aylmer Inc has a December 31, Y7 year end. Aylmer does not perform monthly adjusting entries. The following items relate to

PROBLEM 3 (10 Marks) Aylmer Inc has a December 31, Y7 year end. Aylmer does not perform monthly adjusting entries. The following items relate to transactions that occurred during the year. 1 On June 30, Aylmer paid $18,000 for an annual insurance premium. The policy began on June 30 . The insurance payment was posted to prepaid insurance. 2 December 31 is a Tuesday. Employees are paid weekly and current. Employees work 5 days per week. Average weekly salary for the company is $56,000 per week. 3 On September 30, Aylmer borrowed $45,500 with an interest rate of 5\%. Principle plus interest will be paid back on June 30,Y8. 4 On October 1 , Aylmer purchased a truck for $26,500. The truck has a 6 year useful life with no residual value. 5 On December 2, Aylmer received payment for work to be completed by January 30, Y8. At December 31, Y7, Aylmer has completed 65% of the work. REQUIRED Prepare the appropriate adjusting or correcting entry for each independent item above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts