Question: Problem 3 (10 points, 8 minutes) ABC Corp. issued 5 years ago 225,000 bonds with a coupon rate of 5.69 percent paid semiannually and with

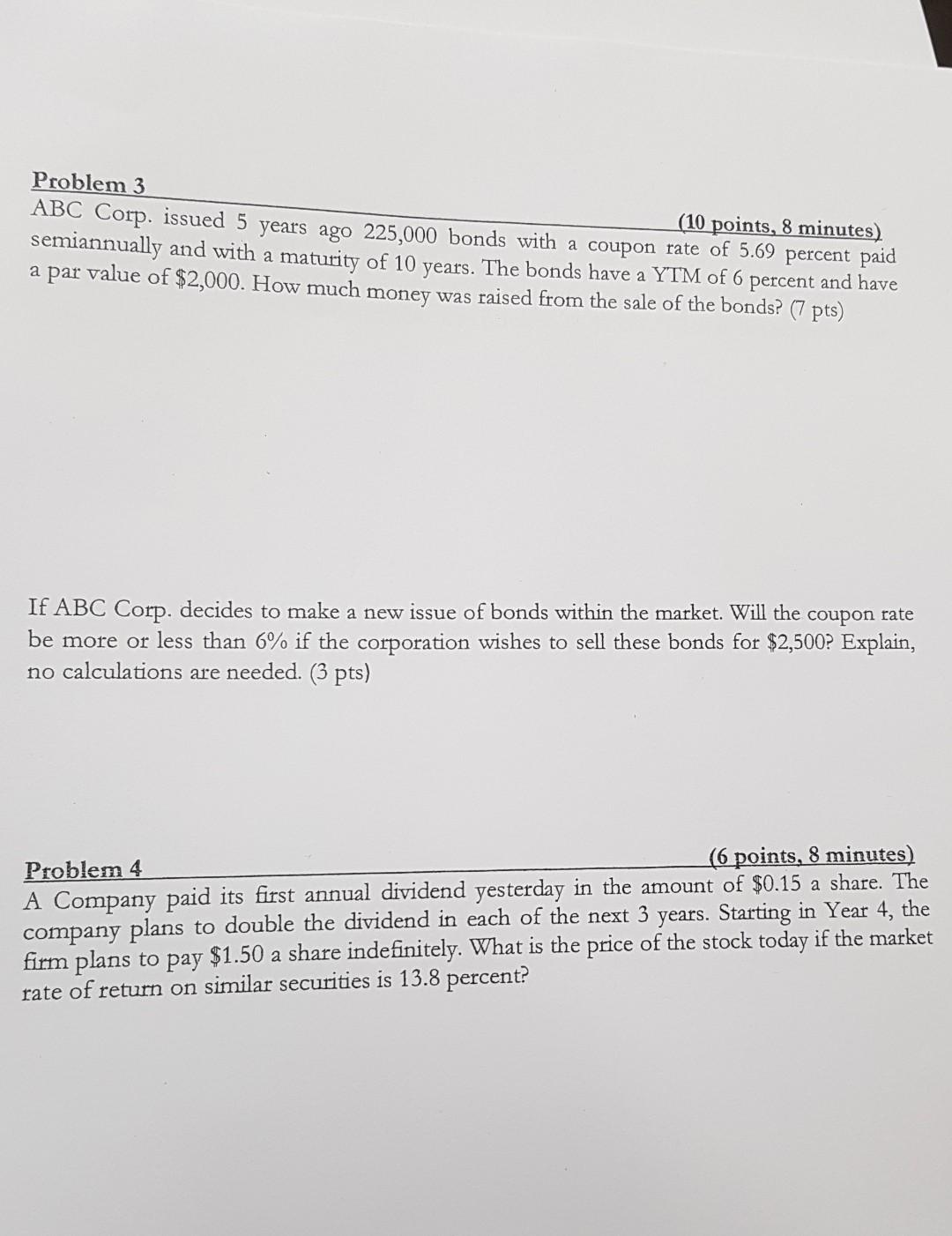

Problem 3 (10 points, 8 minutes) ABC Corp. issued 5 years ago 225,000 bonds with a coupon rate of 5.69 percent paid semiannually and with a maturity of 10 years. The bonds have a YTM of 6 percent and have a par value of $2,000. How much money was raised from the sale of the bonds? (7 pts) If ABC Corp. decides to make a new issue of bonds within the market. Will the coupon rate be more or less than 6% if the corporation wishes to sell these bonds for $2,500? Explain, no calculations are needed. (3 pts) Problem 4 (6 points, 8 minutes) A Company paid its first annual dividend yesterday in the amount of $0.15 a share. The company plans to double the dividend in each of the next 3 years. Starting in Year 4, the firm plans to pay $1.50 a share indefinitely. What is the price of the stock today if the market rate of return on similar securities is 13.8 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts