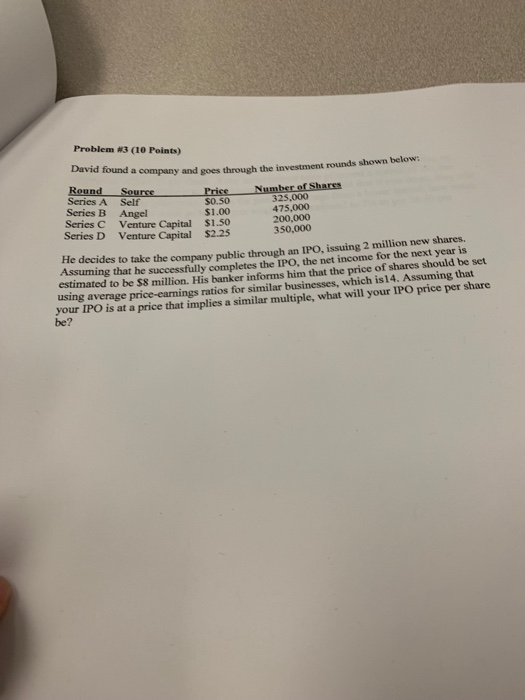

Question: Problem #3 (10 Points) David found a company and goes through the investment rounds shown below: Series A Self Series B Angel Series C Venture

Problem #3 (10 Points) David found a company and goes through the investment rounds shown below: Series A Self Series B Angel Series C Venture Capital $1.50 Series D Venture Capital $2.25 325,000 475,000 200,000 350,000 s0.50 $1.00 He decides to take the company public through an IPO, issuing 2 million new shares. Assuming that he successfully completes the IPO, the net income for the next year is estimated to be $8 million. His banker informs him that the price using average price-earnings ratios for similar businesses, your IPO be? of shares should be set which is14. Assuming that is at a price that implies a similar multiple, what will your IPO price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts