Question: Problem 3 [10 points) (EMH and Long-Term Financing) a) (EMH) i) 3 points) If securities markets are efficient, what is the net prenent value of

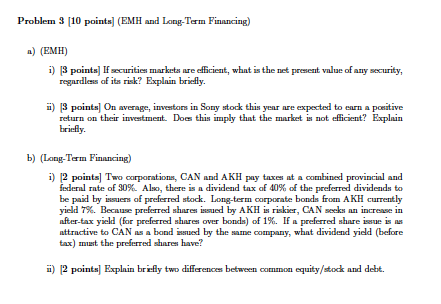

Problem 3 [10 points) (EMH and Long-Term Financing) a) (EMH) i) 3 points) If securities markets are efficient, what is the net prenent value of any security, regardless of its risk? Explain briefly. ) 3 points) On average, investors in Sony stock this year are expected to earn a ponitive return on their investment. Does this imply that the market is not eficient? Explain briefly b) (Long-Term Financing) i) 2 points) Two corporation, CAN and AKH pay taxes at a combined provincial and federal rate of 30%. Also, there is a dividend tax of 40% of the preferred dividends to be paid by issues of preferred stock. Long-term corporate bonds from AKH currently yield 7%. Because preferred shares issued by AKHis riskier, CAN seeks an increase in after-tax yield (for preferred shares over bonds) of 1%. If a preferred share it is attractive to CAN as a band issued by the same company, what dividend yield (before tax) mut the preferred shares have? i) 2 points Explain briefly two differences between common equity/stock and debt. Problem 3 [10 points) (EMH and Long-Term Financing) a) (EMH) i) 3 points) If securities markets are efficient, what is the net prenent value of any security, regardless of its risk? Explain briefly. ) 3 points) On average, investors in Sony stock this year are expected to earn a ponitive return on their investment. Does this imply that the market is not eficient? Explain briefly b) (Long-Term Financing) i) 2 points) Two corporation, CAN and AKH pay taxes at a combined provincial and federal rate of 30%. Also, there is a dividend tax of 40% of the preferred dividends to be paid by issues of preferred stock. Long-term corporate bonds from AKH currently yield 7%. Because preferred shares issued by AKHis riskier, CAN seeks an increase in after-tax yield (for preferred shares over bonds) of 1%. If a preferred share it is attractive to CAN as a band issued by the same company, what dividend yield (before tax) mut the preferred shares have? i) 2 points Explain briefly two differences between common equity/stock and debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts