Question: Problem 3 (12 Marks) ABCO Manufacturing Ltd. has decided to acquire a new piece of processing machinery in order to improve production. The company does

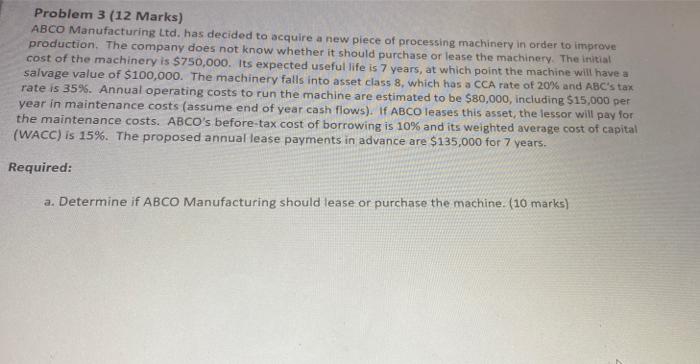

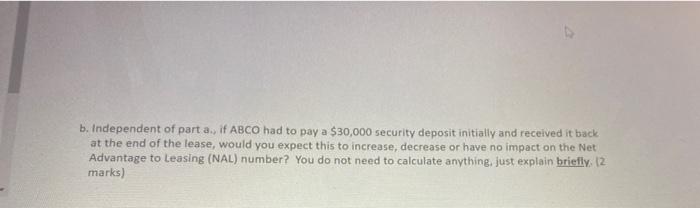

Problem 3 (12 Marks) ABCO Manufacturing Ltd. has decided to acquire a new piece of processing machinery in order to improve production. The company does not know whether it should purchase or lease the machinery. The initial cost of the machinery is $750,000. Its expected useful life is 7 years, at which point the machine will have a salvage value of $100,000. The machinery falls into asset class 8, which has a CCA rate of 20% and ABC's tax rate is 35%. Annual operating costs to run the machine are estimated to be $80,000, including $15,000 per year in maintenance costs (assume end of year cash flows). If ABCO leases this asset, the lessor will pay for the maintenance costs. ABCO's before-tax cost of borrowing is 10% and its weighted average cost of capital (WACC) is 15%. The proposed annual lease payments in advance are $135,000 for 7 years. Required: a. Determine if ABCO Manufacturing should lease or purchase the machine. (10 marks) b. Independent of part a. if ABCO had to pay a $30,000 security deposit initially and received it back at the end of the lease, would you expect this to increase, decrease or have no impact on the Net Advantage to Leasing (NAL) number? You do not need to calculate anything, just explain briefly, 12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts