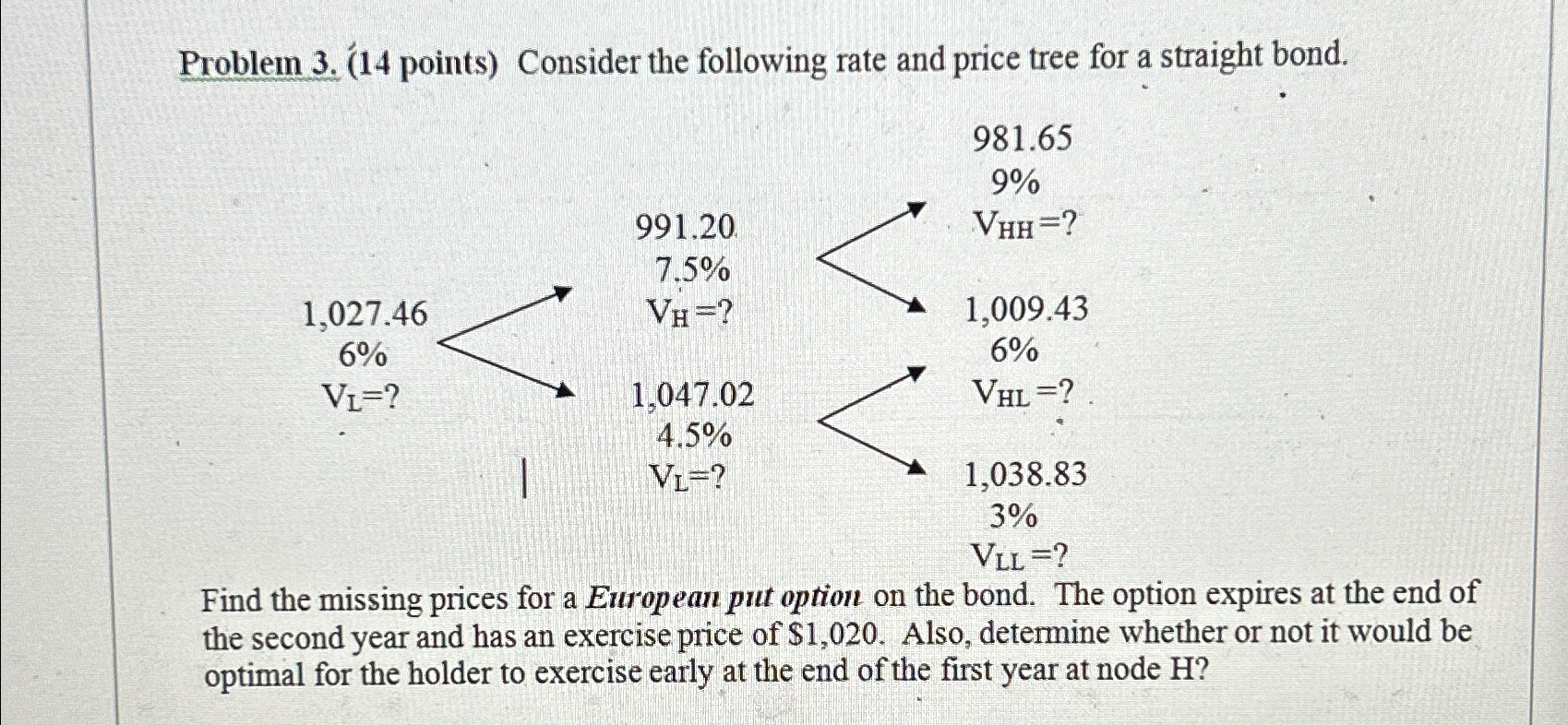

Question: Problem 3. (14 points) Consider the following rate and price tree for a straight bond. 981.65 9% 991.20 VHH=? 7.5% 1,027.46 6% VL=? VH=?

Problem 3. (14 points) Consider the following rate and price tree for a straight bond. 981.65 9% 991.20 VHH=? 7.5% 1,027.46 6% VL=? VH=? 1,009.43 6% 1,047.02 VHL=? 4.5% VL=? 1,038.83 3% VLL =? Find the missing prices for a European put option on the bond. The option expires at the end of the second year and has an exercise price of $1,020. Also, determine whether or not it would be optimal for the holder to exercise early at the end of the first year at node H?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock