Question: Problem 3. (15 points.) Consider a general oneperiod nancial market model with d + 1 assets. Prices at time t = 1 are modelled as

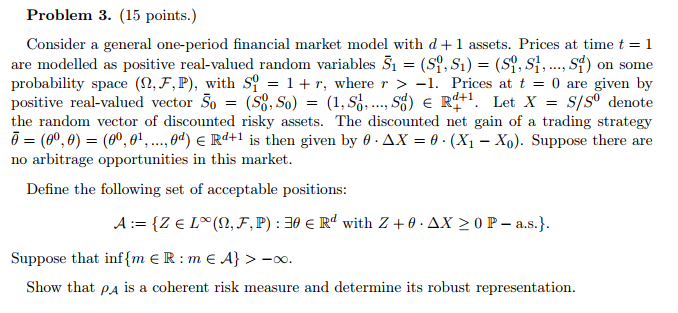

Problem 3. (15 points.) Consider a general oneperiod nancial market model with d + 1 assets. Prices at time t = 1 are modelled as positive realvalued random variables 51 = (3?,31) = [5'1],S:,...,Sf} on some probability space (HURPL with 3'1) = 1 + r, where 1" > 1. Prices at t = 0 are given by positive realvalued vector 5]) = {53,50} 2 [1,S,...,3d) E R1\". Let X = SIS\" denote the random vector of discounted risky assets. The discounted net gain of a trading strategy E7 2 (30,9) 2 (90,61, ...,3\") E 11"!\"+1 is then given by El . {AX = B - [X1 X0}. Suppose there are no arbitrage opportunities in this market. Dene the following set of acceptable positions: .A := {Z E Lm[,.F1P):EIH E Rd with Z+S&X 13 D Pa.s.}. Suppose that in.f{m E IR : m E A} > -oo. Show that pg is a coherent risk measure and determine its robust representation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts