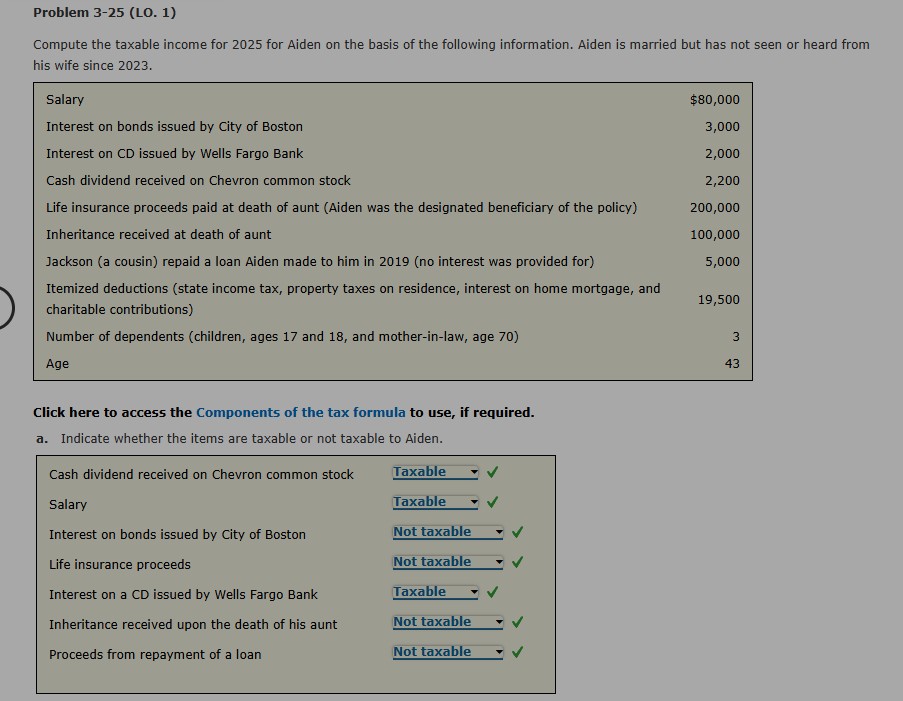

Question: Problem 3 - 2 5 ( LO . 1 ) Compute the taxable income for 2 0 2 5 for Aiden on the basis of

Problem LO Compute the taxable income for for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since Itemized deductions state income tax, property taxes on residence, interest on home mortgage, and charitable contributions Click here to access the Components of the tax formula to use, if required. a Indicate whether the items are taxable or not taxable to Aiden.Taxable checkmark Taxable checkmark Not taxable checkmark Not taxable checkmark Not taxable checkmark Not taxable checkmark

x

c Should Aiden itemize his deductions or take the standard deduction?

He should take the standard deduction.

Feedback

Check My Work

The Internal Revenue Code defines gross income broadly as "except as otherwise provided, all income from whatever source derived." The "except

as otherwise provided" refers to exclusions. Individual taxpayers have two categories of deductions: deductions for adjusted gross income

deductions to arrive at adjusted gross income and deductions from adjusted gross income.

d Aiden's taxable income in is :

I NEED HELP WITH HIS FILING STATUS AND HIS TAXABLE INCOME PLEASE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock