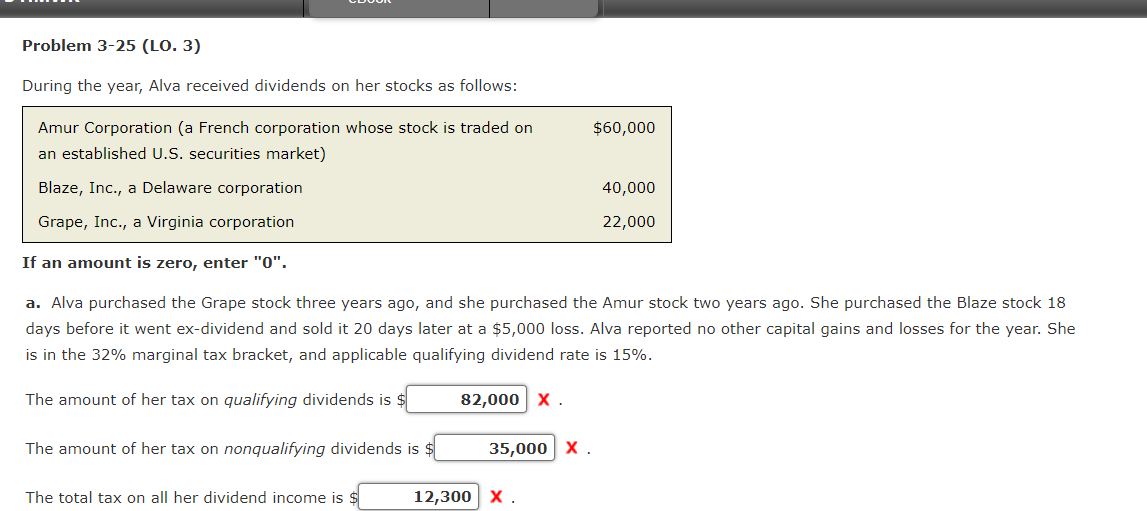

Question: Problem 3 - 2 5 ( LO . 3 ) During the year, Alva received dividends on her stocks as follows: Amur Corporation ( a

Problem LO

During the year, Alva received dividends on her stocks as follows:

Amur Corporation a French corporation whose stock is traded on

an established US securities market $

Blaze, Inc., a Delaware corporation

Grape, Inc., a Virginia corporation

If an amount is zero, enter

Question Content Area

a Alva purchased the Grape stock three years ago, and she purchased the Amur stock two years ago. She purchased the Blaze stock days before it went exdividend and sold it days later at a $ loss. Alva reported no other capital gains and losses for the year. She is in the marginal tax bracket, and applicable qualifying dividend rate is

The amount of her tax on qualifying dividends is $

The amount of her tax on nonqualifying dividends is $

The total tax on all her dividend income is $

Problem LO

During the year, Alva received dividends on her stocks as follows:

If an amount is zero, enter

a Alva purchased the Grape stock three years ago, and she purchased the Amur stock two years ago. She purchased the Blaze stock

days before it went exdividend and sold it days later at a $ loss. Alva reported no other capital gains and losses for the year. She

is in the marginal tax bracket, and applicable qualifying dividend rate is

The amount of her tax on qualifying dividends is $

The amount of her tax on nonqualifying dividends is $

The total tax on all her dividend income is $

Question Content Area

b Alvas daughter, Veda, who is age and who is not Alvas dependent, reported taxable income of $ which included $ of dividends on Grape stock. Veda purchased the stock two years ago.

Vedas tax liability on the dividends is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock