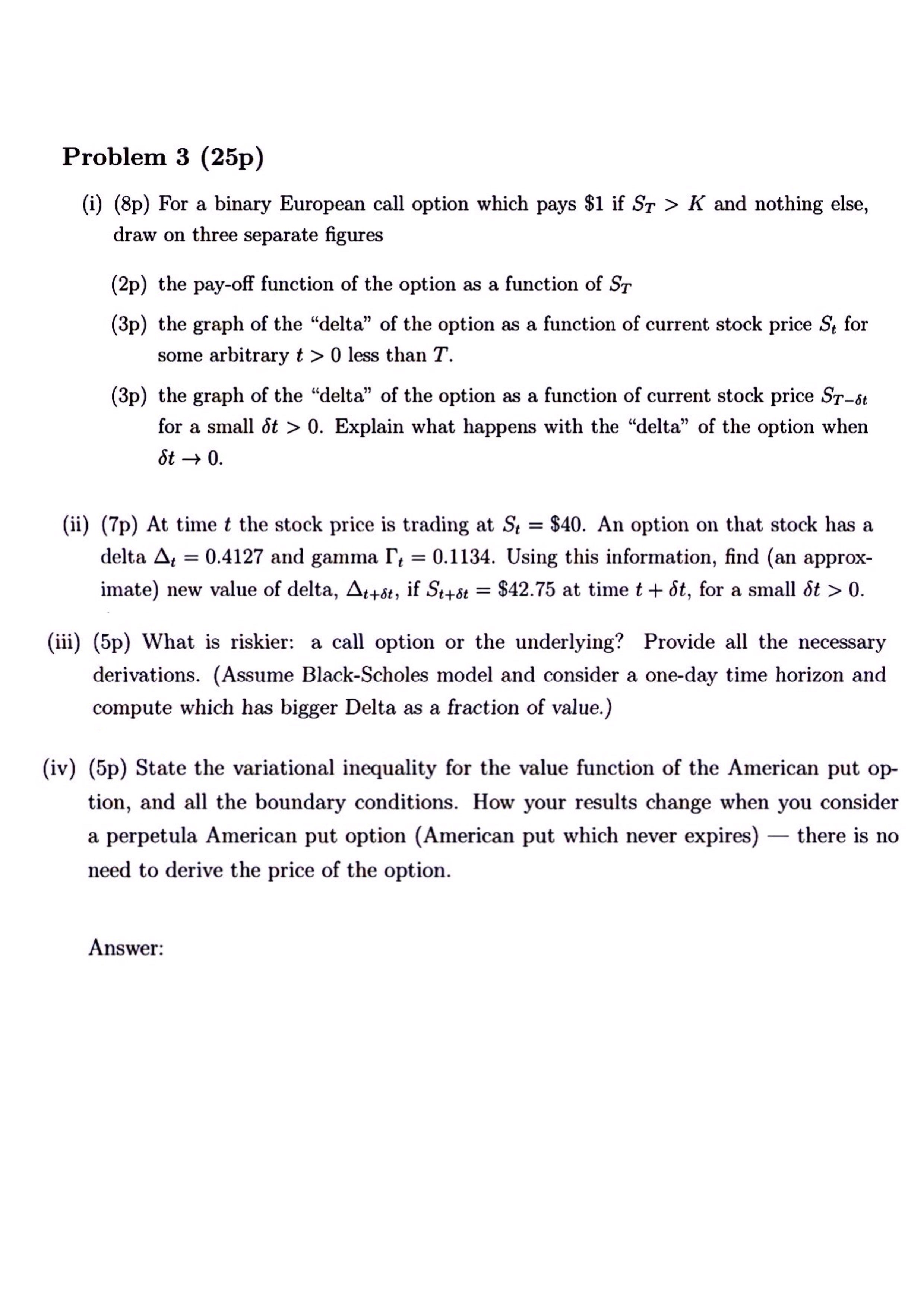

Question: Problem 3 ( 2 5 p ) ( i ) ( 8 p ) For a binary European call option which pays $ 1 if

Problem p

ip For a binary European call option which pays $ if and nothing else, draw on three separate figures

p the payoff function of the option as a function of

p the graph of the "delta" of the option as a function of current stock price for some arbitrary less than

p the graph of the "delta" of the option as a function of current stock price for a small Explain what happens with the "delta" of the option when

iip At time the stock price is trading at $ An option on that stock has a delta and gamma Using this information, find an approximate new value of delta, if $ at time for a small

iiip What is riskier: a call option or the underlying? Provide all the necessary derivations. Assume BlackScholes model and consider a oneday time horizon and compute which has bigger Delta as a fraction of value.

ivp State the variational inequality for the value function of the American put option, and all the boundary conditions. How your results change when you consider a perpetula American put option American put which never expires there is no need to derive the price of the option.

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock