Question: Problem 3 (2 points) A $7,480,000 portfolio has a beta of 1.25. The E-mini S&P 500 Futures contract currently trades for 3,400 and the contract

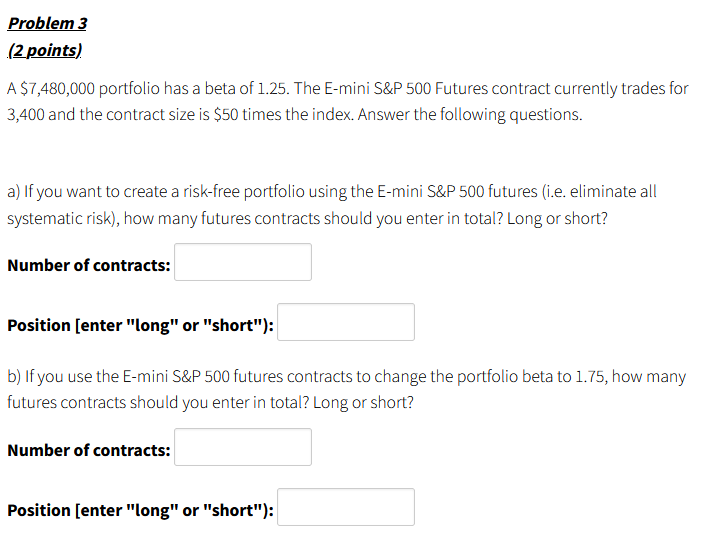

Problem 3 (2 points) A $7,480,000 portfolio has a beta of 1.25. The E-mini S&P 500 Futures contract currently trades for 3,400 and the contract size is $50 times the index. Answer the following questions. a) If you want to create a risk-free portfolio using the E-mini S&P 500 futures (i.e. eliminate all systematic risk), how many futures contracts should you enter in total? Long or short? Number of contracts: Position Center "long" or "short"): b) If you use the E-mini S&P 500 futures contracts to change the portfolio beta to 1.75, how many futures contracts should you enter in total? Long or short? Number of contracts: Position (enter "long" or "short")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts