Question: Problem # 3 ( 2 points ) Stockton Incorporated began operations in January 2 0 2 4 . For some property sales, Stockton recognizes income

Problem # points

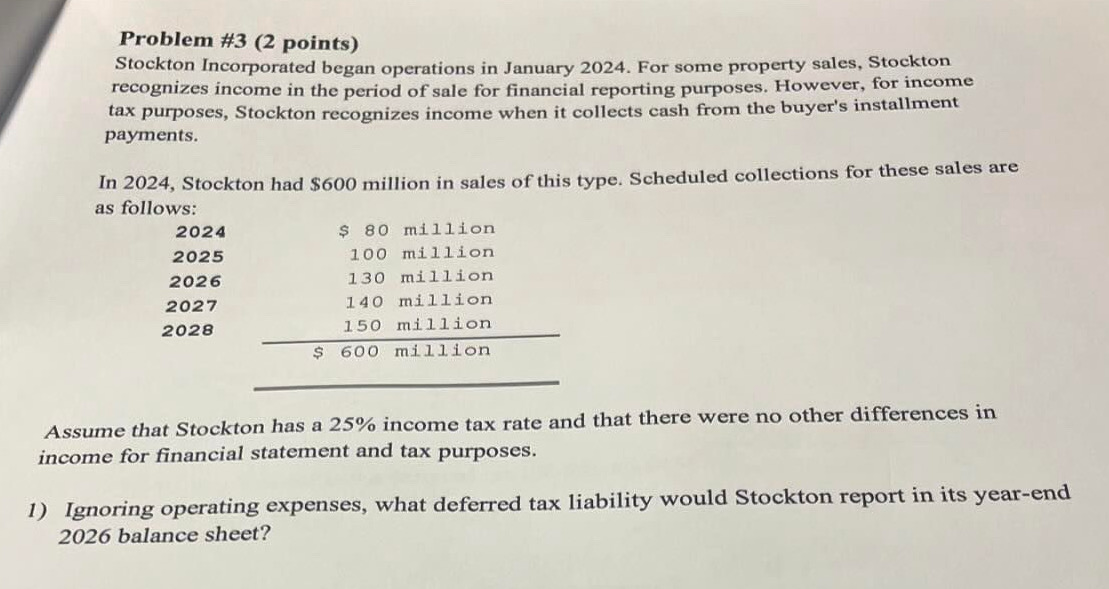

Stockton Incorporated began operations in January For some property sales, Stockton

recognizes income in the period of sale for financial reporting purposes. However, for income

tax purposes, Stockton recognizes income when it collects cash from the buyer's installment

payments.

In Stockton had $ million in sales of this type. Scheduled collections for these sales are

as follows:

Assume that Stockton has a income tax rate and that there were no other differences in

income for financial statement and tax purposes.

Ignoring operating expenses, what deferred tax liability would Stockton report in its yearend

balance sheet?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock