Question: Problem 3 (2 points) Two investment advisers are comparing performance. Adviser A averaged a 18% return with a portfolio beta of 1.7, and adviser B

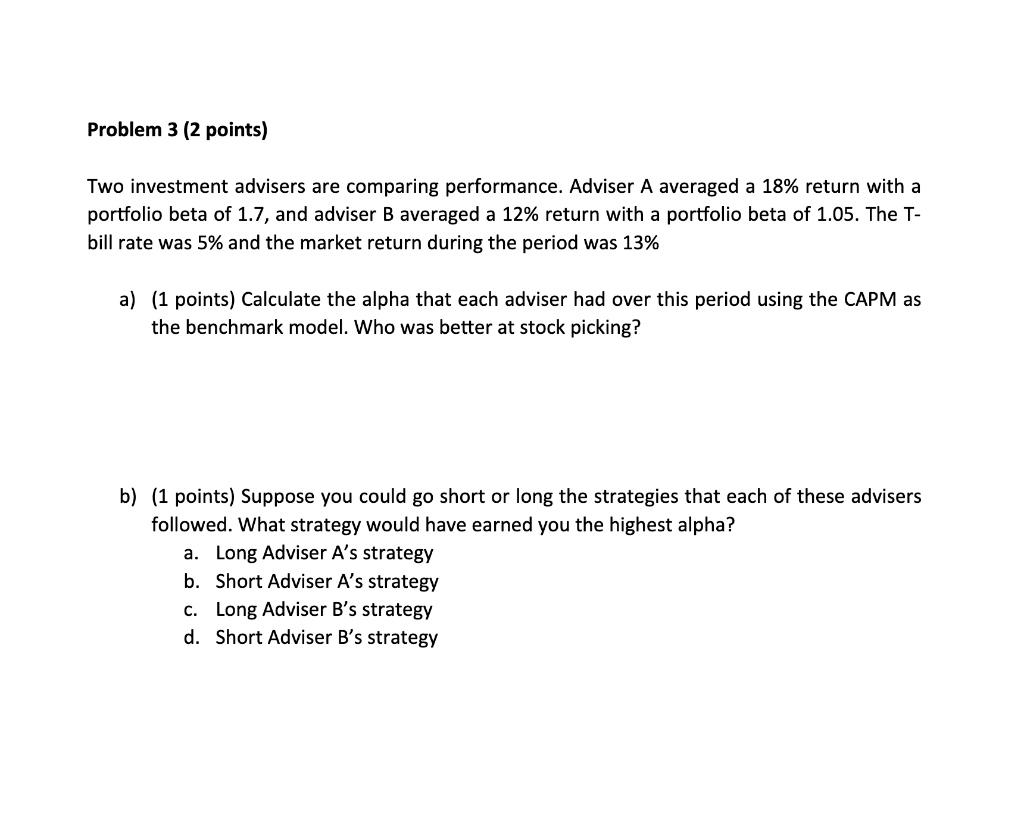

Problem 3 (2 points) Two investment advisers are comparing performance. Adviser A averaged a 18% return with a portfolio beta of 1.7, and adviser B averaged a 12% return with a portfolio beta of 1.05. The T- bill rate was 5% and the market return during the period was 13% a) (1 points) Calculate the alpha that each adviser had over this period using the CAPM as the benchmark model. Who was better at stock picking? b) (1 points) Suppose you could go short or long the strategies that each of these advisers followed. What strategy would have earned you the highest alpha? a. Long Adviser A's strategy b. Short Adviser A's strategy c. Long Adviser B's strategy d. Short Adviser B's strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts