Question: Problem 3 (20 points) - A two stage model for AAPL using its Free Cash Flow to Equity: Use Bloomberg to get the estimated growth

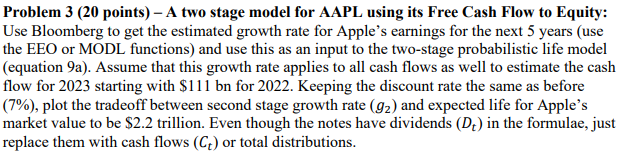

Problem 3 (20 points) - A two stage model for AAPL using its Free Cash Flow to Equity: Use Bloomberg to get the estimated growth rate for Apple's earnings for the next 5 years (use the EEO or MODL functions) and use this as an input to the two-stage probabilistic life model (equation 9a ). Assume that this growth rate applies to all cash flows as well to estimate the cash flow for 2023 starting with $111 bn for 2022 . Keeping the discount rate the same as before (7\%), plot the tradeoff between second stage growth rate (g2) and expected life for Apple's market value to be $2.2 trillion. Even though the notes have dividends (Dt) in the formulae, just replace them with cash flows (Ct) or total distributions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts