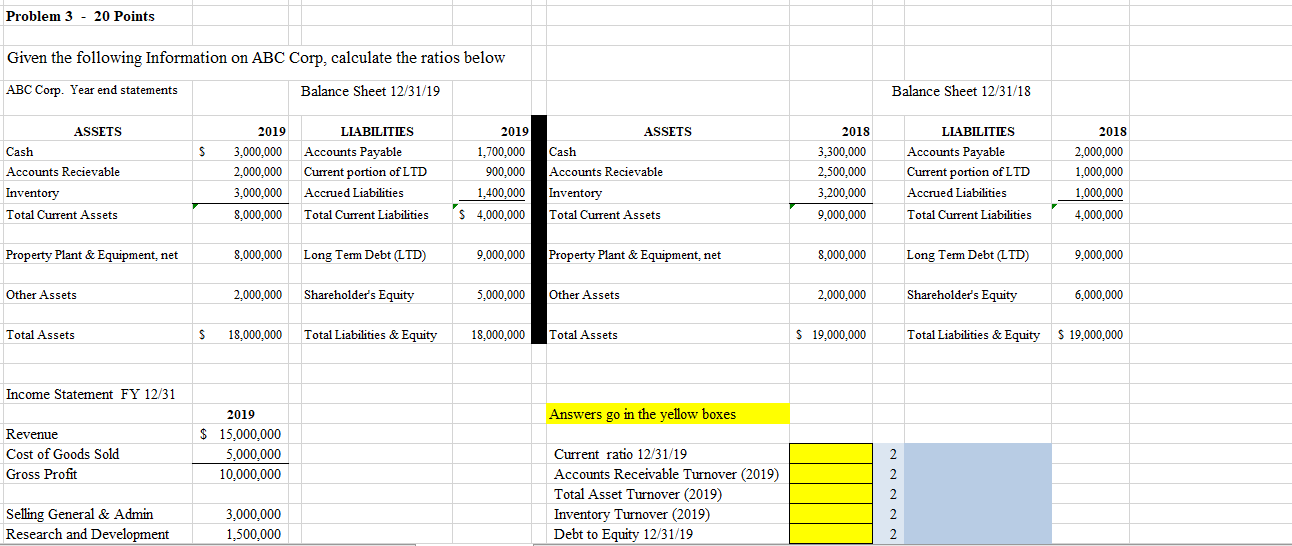

Question: Problem 3 - 20 Points Given the following Information on ABC Corp, calculate the ratios below ABC Corp. Year end statements Balance Sheet 12/31/19 Balance

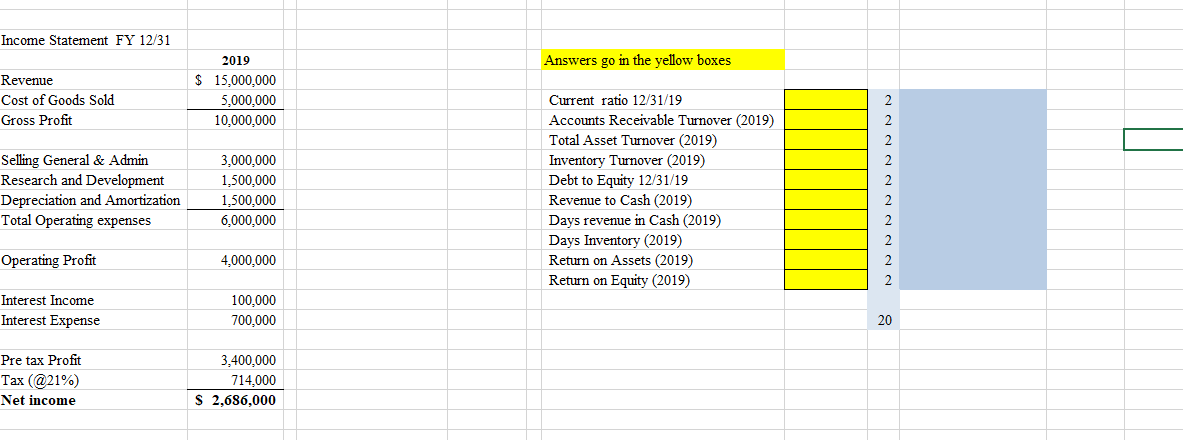

Problem 3 - 20 Points Given the following Information on ABC Corp, calculate the ratios below ABC Corp. Year end statements Balance Sheet 12/31/19 Balance Sheet 12/31/18 ASSETS $ Cash ASSETS Cash Accounts Recievable Inventory Total Current Assets 2019 3,000,000 2,000,000 3,000,000 8,000,000 LLABILITIES Accounts Payable Current portion of LTD Accrued Liabilities Total Current Liabilities 2019 1,700,000 900.000 1,400,000 $ 4,000,000 Accounts Recievable Inventory Total Current Assets 2018 3,300,000 2,500,000 3,200,000 9,000,000 LLABILITIES Accounts Payable Current portion of LTD Accrued Liabilities Total Current Liabilities 2018 2,000,000 1,000,000 1,000,000 4,000,000 Property Plant & Equipment, net 8,000,000 Long Term Debt (LTD) 9,000,000 Property Plant & Equipment, net 8,000,000 Long Term Debt (LTD) 9,000,000 Other Assets 2,000,000 Shareholder's Equity 5,000,000 Other Assets 2.000.000 Shareholder's Equity 6,000,000 Total Assets $ 18,000,000 Total Liabilities & Equity 18.000.000 Total Assets $ 19,000,000 Total Liabilities & Equity S 19,000,000 Income Statement FY 12/31 Answers go in the yellow boxes Revenue Cost of Goods Sold Gross Profit 2019 $ 15,000,000 5,000,000 10,000,000 2 Current ratio 12/31/19 Accounts Receivable Turnover (2019) Total Asset Turnover (2019) Inventory Turnover (2019) Debt to Equity 12/31/19 Selling General & Admin Research and Development 3,000,000 1,500,000 2 Income Statement FY 12/31 Answers go in the yellow boxes Revenue Cost of Goods Sold Gross Profit 2019 $ 15,000,000 5,000,000 10,000,000 2 2 2 2 Selling General & Admin Research and Development Depreciation and Amortization Total Operating expenses 3,000,000 1,500,000 1,500,000 6,000,000 Current ratio 12/31/19 Accounts Receivable Turnover (2019) Total Asset Turnover (2019) Inventory Turnover (2019) Debt to Equity 12/31/19 Revenue to Cash (2019) Days revenue in Cash (2019) Days Inventory (2019) Return on Assets (2019) Return on Equity (2019) 2 2. 2 Operating Profit 4,000,000 2 2 Interest Income Interest Expense 100,000 700,000 20 Pre tax Profit Tax (@21%) Net income 3,400,000 714,000 $ 2,686,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts