Question: PROBLEM #3 (20 points): WB. Jones Heating & Air has an equity value of $4 billion and a total asset value of $5 billion. They

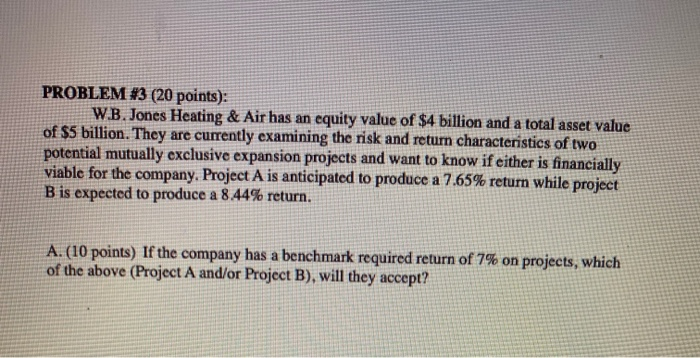

PROBLEM #3 (20 points): WB. Jones Heating & Air has an equity value of $4 billion and a total asset value of $5 billion. They are currently examining the risk and return characteristics of two potential mutually exclusive expansion projects and want to know if either is financially viable for the company. Project A is anticipated to produce a 7.65% return while project B is expected to produce a 8.44% return. A. (10 points) If the company has a benchmark required return of 7% on projects, which of the above (Project A and/or Project B), will they accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts