Question: Problem 3 (22 marks) Fruity Ltd. has two divisions: Cold Apple and Warm Orange. You have the following information about Fruity Ltd.: Cold Apple Division:

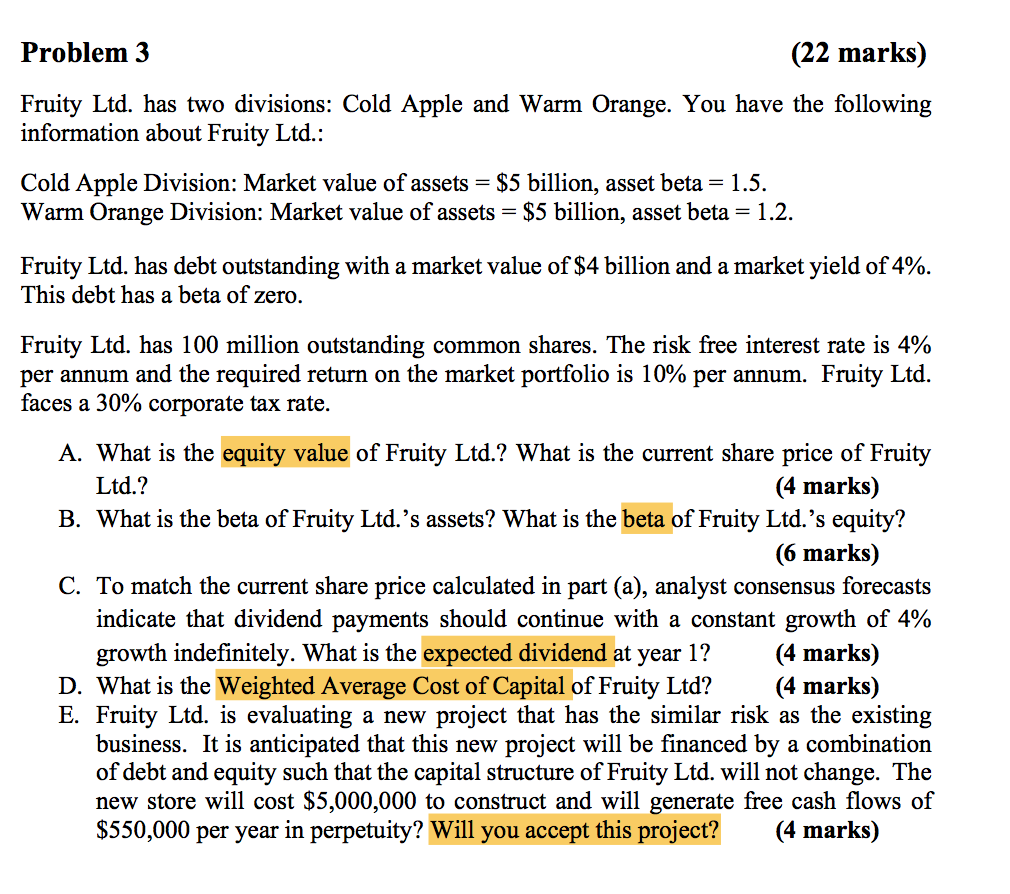

Problem 3 (22 marks) Fruity Ltd. has two divisions: Cold Apple and Warm Orange. You have the following information about Fruity Ltd.: Cold Apple Division: Market value of assets - $5 billion, asset beta- 1.5. Warm Orange Division: Market value of assets - $5 billion, asset beta -1.2 Fruity Ltd. has debt outstanding with a market value of $4 billion and a market yield of 4% This debt has a beta of zero. Fruity Ltd. has 100 million outstanding common shares. The risk free interest rate is 4% per annum and the required return on the market portfolio is 10% per annum. Fruity Ltd faces a 30% corporate tax rate. A. What is the equity value of Fruity Ltd.? What is the current share price of Fruity Ltd.? B. What is the beta of Fruity Ltd.'s assets? What is the beta of Fruity Ltd.'s equity? (4 marks) (6 marks) C. To match the current share price calculated in part (a), analyst consensus forecasts indicate that dividend payments should continue with a constant growth of 4% growth indefinitely. What is the expected dividend at year 1?(4 marks) D. What is the Weighted Average Cost of Capital of Fruity Ltd?(4 marks) E. Fruity Ltd. is evaluating a new project that has the similar risk as the existing business. It is anticipated that this new project will be financed by a combination of debt and equity such that the capital structure of Fruity Ltd. will not change. The new store will cost $5,000,000 to construct and will generate free cash flows of S550,000 per year in perpetuity? Will you accept this project?(4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts