Question: Problem 3 (24 points) Consider a stock index fund that has a current value of $1200. A dividend of $10 will be paid on the

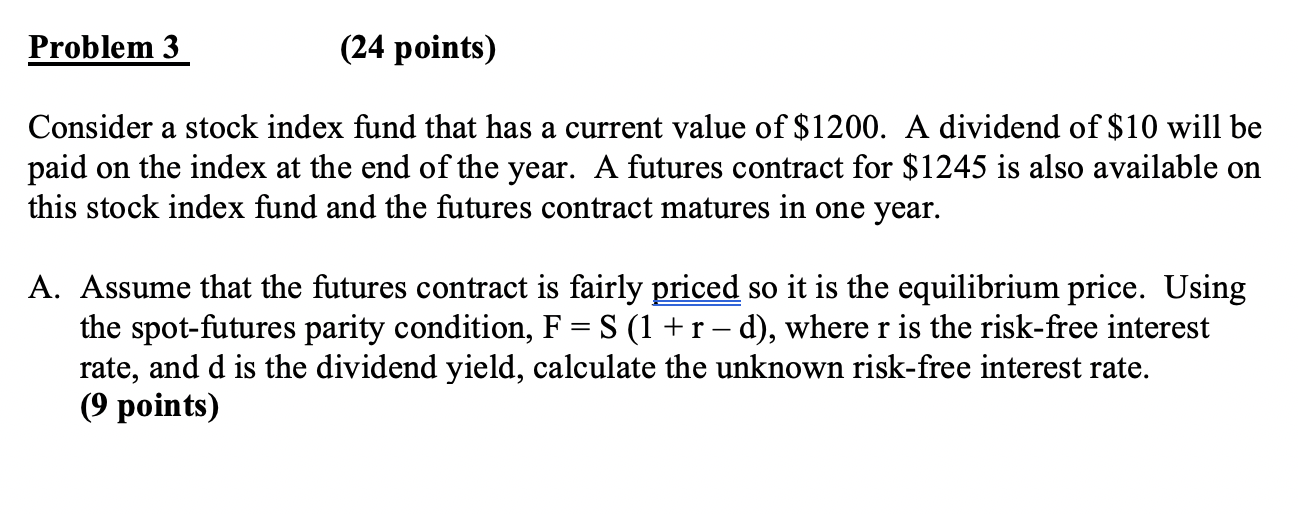

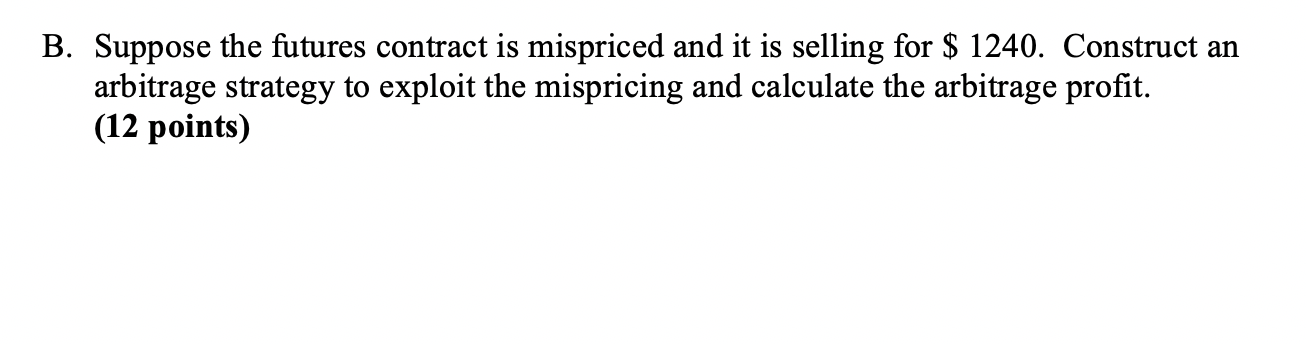

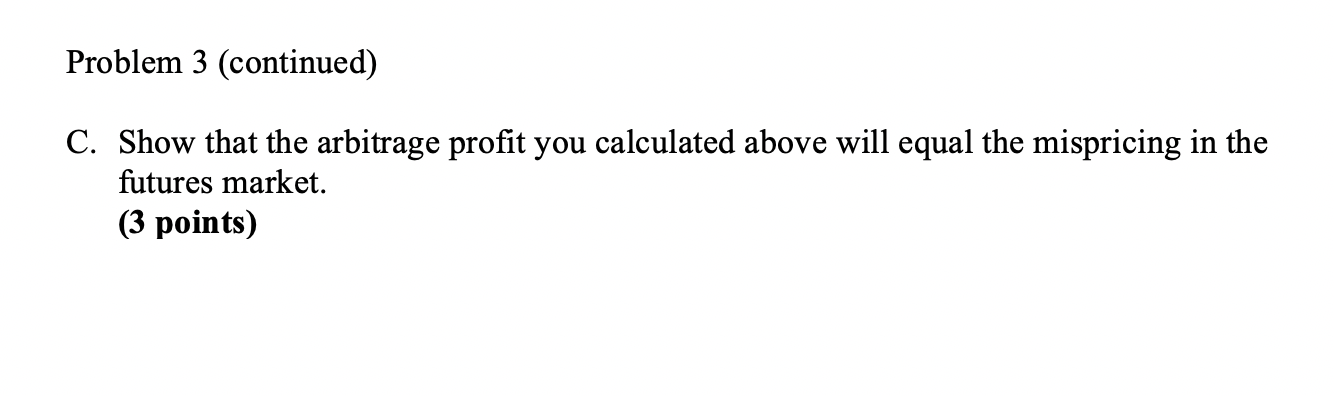

Problem 3 (24 points) Consider a stock index fund that has a current value of $1200. A dividend of $10 will be paid on the index at the end of the year. A futures contract for $1245 is also available on this stock index fund and the futures contract matures in one year. A. Assume that the futures contract is fairly priced so it is the equilibrium price. Using the spot-futures parity condition, F =S (1+r - d), where r is the risk-free interest rate, and d is the dividend yield, calculate the unknown risk-free interest rate. (9 points) B. Suppose the futures contract is mispriced and it is selling for $ 1240. Construct an arbitrage strategy to exploit the mispricing and calculate the arbitrage profit. (12 points) Problem 3 (continued) C. Show that the arbitrage profit you calculated above will equal the mispricing in the futures market. (3 points) Problem 3 (24 points) Consider a stock index fund that has a current value of $1200. A dividend of $10 will be paid on the index at the end of the year. A futures contract for $1245 is also available on this stock index fund and the futures contract matures in one year. A. Assume that the futures contract is fairly priced so it is the equilibrium price. Using the spot-futures parity condition, F =S (1+r - d), where r is the risk-free interest rate, and d is the dividend yield, calculate the unknown risk-free interest rate. (9 points) B. Suppose the futures contract is mispriced and it is selling for $ 1240. Construct an arbitrage strategy to exploit the mispricing and calculate the arbitrage profit. (12 points) Problem 3 (continued) C. Show that the arbitrage profit you calculated above will equal the mispricing in the futures market. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts