Question: Problem 3 (25 points) Suppose a stock S has an expected return u of 10% per annum, a a of 15% per annum and that

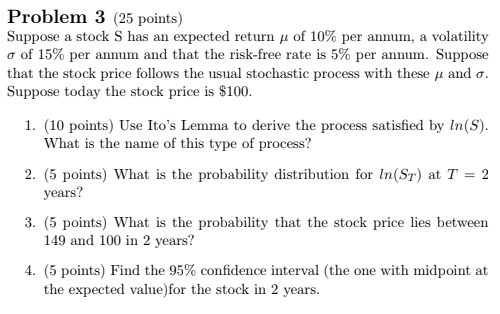

Problem 3 (25 points) Suppose a stock S has an expected return u of 10% per annum, a a of 15% per annum and that the risk-free rate is 5% per annum. Suppose that the stock price follows the usual stochastic process with these and Suppose today the stock price is $100 volatility 1. (10 points) Use Ito's Lemma to derive the process satisfied by In(S) What is the name of this type of process? 2. (5 points) What is the probability distribution for ln(Sr) at T = 2 years? 3. (5 points) What is the probability that the stock price lies between 149 and 100 in 2 years? 4. (5 points) Find the 95% confidence interval (the one with midpoint at the expected value)for the stock in 2 years. Problem 3 (25 points) Suppose a stock S has an expected return u of 10% per annum, a a of 15% per annum and that the risk-free rate is 5% per annum. Suppose that the stock price follows the usual stochastic process with these and Suppose today the stock price is $100 volatility 1. (10 points) Use Ito's Lemma to derive the process satisfied by In(S) What is the name of this type of process? 2. (5 points) What is the probability distribution for ln(Sr) at T = 2 years? 3. (5 points) What is the probability that the stock price lies between 149 and 100 in 2 years? 4. (5 points) Find the 95% confidence interval (the one with midpoint at the expected value)for the stock in 2 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts