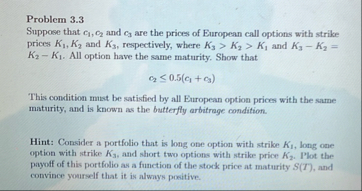

Question: Problem 3 . 3 Suppose that c 1 , c 2 and c 3 are the prices of European call options with strike prices K

Problem

Suppose that and are the prices of European call options with strike prices and respectively, where and All option have the same maturity. Show that

This condition must be satisfied by all European option prices with the same maturity, and is known as the butterfly arbitrage condition.

Hint: Consider a portfolio that is long one option with strike long one option with strike and short two options with strike price Plot the payoff of this portfolio as a function of the stock price at maturity and convince yourself that it is alwnys positive.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock