Question: Problem 3 (30 points). Consider a 3-step Binomial Asset Pricing Model with probability p of going up by a factor u, and probability q=1-p of

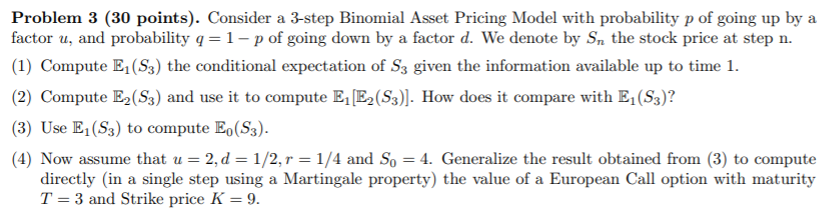

Problem 3 (30 points). Consider a 3-step Binomial Asset Pricing Model with probability p of going up by a factor u, and probability q=1-p of going down by a factor d. We denote by Sn the stock price at step n. (1) Compute E (S3) the conditional expectation of S3 given the information available up to time 1. (2) Compute E2(S3) and use it to compute E1 E2(S3)]. How does it compare with E1 (S3)? (3) Use E1 (S3) to compute E.(S3). (4) Now assume that u = 2, d = 1/2, r = 1/4 and So = 4. Generalize the result obtained from (3) to compute directly in a single step using a Martingale property) the value of a European Call option with maturity T= 3 and Strike price K = 9. Problem 3 (30 points). Consider a 3-step Binomial Asset Pricing Model with probability p of going up by a factor u, and probability q=1-p of going down by a factor d. We denote by Sn the stock price at step n. (1) Compute E (S3) the conditional expectation of S3 given the information available up to time 1. (2) Compute E2(S3) and use it to compute E1 E2(S3)]. How does it compare with E1 (S3)? (3) Use E1 (S3) to compute E.(S3). (4) Now assume that u = 2, d = 1/2, r = 1/4 and So = 4. Generalize the result obtained from (3) to compute directly in a single step using a Martingale property) the value of a European Call option with maturity T= 3 and Strike price K = 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts