Question: Problem (3) 30 Pts You plan to borrow $750K (10 years mortgage) to purchase a local chemical plant of value $1M. The nominal interest rate

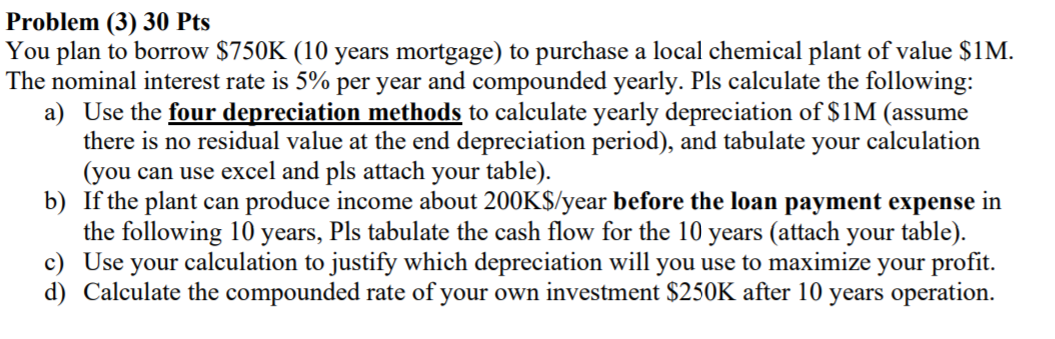

Problem (3) 30 Pts You plan to borrow $750K (10 years mortgage) to purchase a local chemical plant of value $1M. The nominal interest rate is 5% per year and compounded yearly. Pls calculate the following: a) Use the four depreciation methods to calculate yearly depreciation of $1M (assume there is no residual value at the end depreciation period), and tabulate your calculation (you can use excel and pls attach your table). b) If the plant can produce income about 200K$/year before the loan payment expense in the following 10 years, Pls tabulate the cash flow for the 10 years (attach your table). c) Use your calculation to justify which depreciation will you use to maximize your profit. d) Calculate the compounded rate of your own investment $250K after 10 years operation. Problem (3) 30 Pts You plan to borrow $750K (10 years mortgage) to purchase a local chemical plant of value $1M. The nominal interest rate is 5% per year and compounded yearly. Pls calculate the following: a) Use the four depreciation methods to calculate yearly depreciation of $1M (assume there is no residual value at the end depreciation period), and tabulate your calculation (you can use excel and pls attach your table). b) If the plant can produce income about 200K$/year before the loan payment expense in the following 10 years, Pls tabulate the cash flow for the 10 years (attach your table). c) Use your calculation to justify which depreciation will you use to maximize your profit. d) Calculate the compounded rate of your own investment $250K after 10 years operation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts