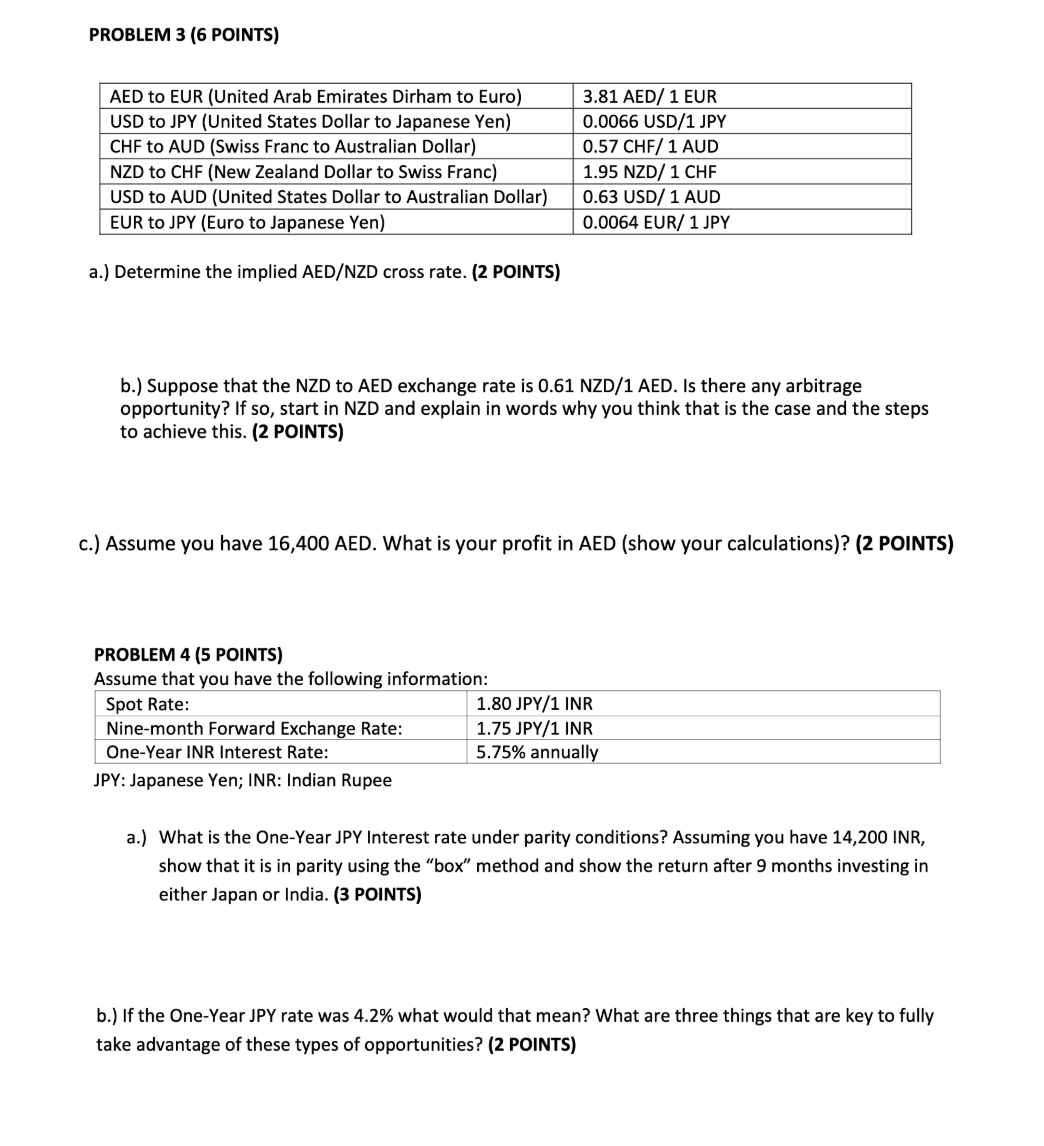

Question: PROBLEM 3 ( 6 POINTS ) a . ) Determine the implied AED / NZD cross rate. ( 2 POINTS ) b . ) Suppose

PROBLEM POINTS

a Determine the implied AEDNZD cross rate. POINTS

b Suppose that the NZD to AED exchange rate is NZD AED. Is there any arbitrage opportunity? If so start in NZD and explain in words why you think that is the case and the steps to achieve this. POINTS

c Assume you have AED. What is your profit in AED show your calculations POINTS

PROBLEM POINTS

Assume that you have the following information:

JPY: Japanese Yen; INR: Indian Rupee

a What is the OneYear JPY Interest rate under parity conditions? Assuming you have INR, show that it is in parity using the "box" method and show the return after months investing in either Japan or India. POINTS

b If the OneYear JPY rate was what would that mean? What are three things that are key to fully take advantage of these types of opportunities? POINTS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock