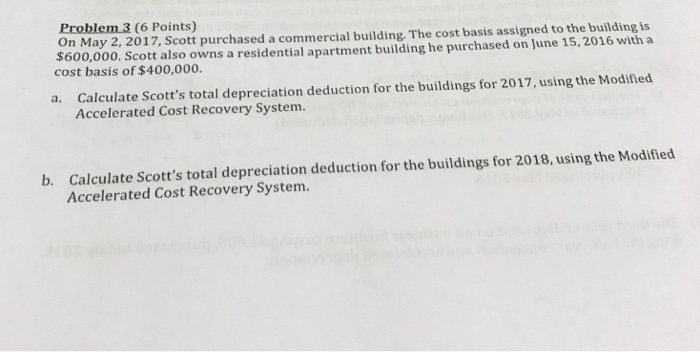

Question: Problem 3 (6 Points) On May 2, 2017, Scott purchased a commercial building. The cost basis assigned to the buildings $600,000. Scott also owns a

Problem 3 (6 Points) On May 2, 2017, Scott purchased a commercial building. The cost basis assigned to the buildings $600,000. Scott also owns a residential apartment building he purchased on June 15, 2016 with a cost basis of $400,000 Calculate Scott's total depreciation deduction for the buildings for 2017,using the Modified Accelerated Cost Recovery System a. Calculate Scott's total depreciation deduction for the buildings for 2018, using the Modified Accelerated Cost Recovery System. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts