Question: Problem 3 (8 points) 2020 was a tough year for Canadian Marijuana growers. High expectations around the legalization in October 2018 lead to initial strong

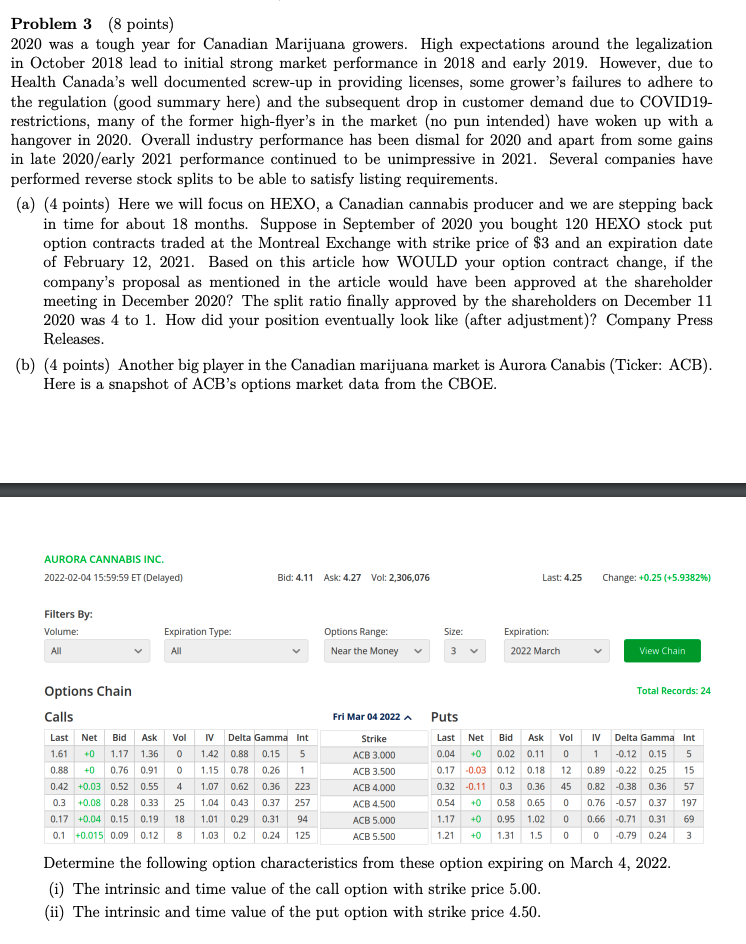

Problem 3 (8 points) 2020 was a tough year for Canadian Marijuana growers. High expectations around the legalization in October 2018 lead to initial strong market performance in 2018 and early 2019. However, due to Health Canada's well documented screw-up in providing licenses, some grower's failures to adhere to the regulation (good summary here) and the subsequent drop in customer demand due to COVID19- restrictions, many of the former high-flyer's in the market (no pun intended) have woken up with a hangover in 2020. Overall industry performance has been dismal for 2020 and apart from some gains in late 2020/early 2021 performance continued to be unimpressive in 2021. Several companies have performed reverse stock splits to be able to satisfy listing requirements. (a) (4 points) Here we will focus on HEXO, a Canadian cannabis producer and we are stepping back in time for about 18 months. Suppose in September of 2020 you bought 120 HEXO stock put option contracts traded at the Montreal Exchange with strike price of $3 and an expiration date of February 12, 2021. Based on this article how WOULD your option contract change, if the company's proposal as mentioned in the article would have been approved at the shareholder meeting in December 2020? The split ratio finally approved by the shareholders on December 11 2020 was 4 to 1. How did your position eventually look like after adjustment)? Company Press Releases. (b) (4 points) Another big player in the Canadian marijuana market is Aurora Canabis (Ticker: ACB). Here is a snapshot of ACB's options market data from the CBOE. AURORA CANNABIS INC. 2022-02-04 15:59:59 ET (Delayed) Bid: 4.11 Ask: 4.27 Vol: 2,306,076 Last: 4.25 Change: +0.25 (+5.9382%) Filters By: Volume: Size: Expiration Type: All Options Range: Near the Money Expiration: 2022 March All 3 View Chain Options Chain Calls Oo Last Net Bid Ask 1.61 +0 1.17 1.36 0.88 +0 0.76 0.91 0.42 +0.03 0.52 0.55 +0.08 0.28 0.33 0.17 +0.04 0.15 0.19 0.1 +0.015 0.09 0.12 Vol 0 0 4 25 18 IV Delta Gamma Int 1.42 0.88 0.15 5 1.15 0.78 0.26 1 1.07 0.62 0.36 223 1.04 0.43 0.37 257 1.01 0.29 0.31 94 1.03 0.2 0.24 125 Total Records: 24 Fri Mar 04 2022 Puts Strike Last Net Bid Ask Vol IV Delta Gamma Int ACB 3.000 0.04 +0 0.02 0.11 0 1 -0.12 0.15 5 ACB 3.500 0.17 -0.03 0.12 0.18 12 0.89 -0.22 0.25 15 ACB 4.000 0.32 -0.11 0.3 0.36 45 0.82 -0.38 0.36 57 ACB 4.500 0.54 +0 0.58 0.65 0 0.76 -0.57 0.37 197 ACB 5.000 1.17 +0 0.95 1.0200.66 -0.71 0.31 69 ACB 5.500 1.21 +0 1.31 1.5 0 0 -0.79 0.24 3 0.3 8 Determine the following option characteristics from these option expiring on March 4, 2022. (i) The intrinsic and time value of the call option with strike price 5.00. (ii) The intrinsic and time value of the put option with strike price 4.50. Problem 3 (8 points) 2020 was a tough year for Canadian Marijuana growers. High expectations around the legalization in October 2018 lead to initial strong market performance in 2018 and early 2019. However, due to Health Canada's well documented screw-up in providing licenses, some grower's failures to adhere to the regulation (good summary here) and the subsequent drop in customer demand due to COVID19- restrictions, many of the former high-flyer's in the market (no pun intended) have woken up with a hangover in 2020. Overall industry performance has been dismal for 2020 and apart from some gains in late 2020/early 2021 performance continued to be unimpressive in 2021. Several companies have performed reverse stock splits to be able to satisfy listing requirements. (a) (4 points) Here we will focus on HEXO, a Canadian cannabis producer and we are stepping back in time for about 18 months. Suppose in September of 2020 you bought 120 HEXO stock put option contracts traded at the Montreal Exchange with strike price of $3 and an expiration date of February 12, 2021. Based on this article how WOULD your option contract change, if the company's proposal as mentioned in the article would have been approved at the shareholder meeting in December 2020? The split ratio finally approved by the shareholders on December 11 2020 was 4 to 1. How did your position eventually look like after adjustment)? Company Press Releases. (b) (4 points) Another big player in the Canadian marijuana market is Aurora Canabis (Ticker: ACB). Here is a snapshot of ACB's options market data from the CBOE. AURORA CANNABIS INC. 2022-02-04 15:59:59 ET (Delayed) Bid: 4.11 Ask: 4.27 Vol: 2,306,076 Last: 4.25 Change: +0.25 (+5.9382%) Filters By: Volume: Size: Expiration Type: All Options Range: Near the Money Expiration: 2022 March All 3 View Chain Options Chain Calls Oo Last Net Bid Ask 1.61 +0 1.17 1.36 0.88 +0 0.76 0.91 0.42 +0.03 0.52 0.55 +0.08 0.28 0.33 0.17 +0.04 0.15 0.19 0.1 +0.015 0.09 0.12 Vol 0 0 4 25 18 IV Delta Gamma Int 1.42 0.88 0.15 5 1.15 0.78 0.26 1 1.07 0.62 0.36 223 1.04 0.43 0.37 257 1.01 0.29 0.31 94 1.03 0.2 0.24 125 Total Records: 24 Fri Mar 04 2022 Puts Strike Last Net Bid Ask Vol IV Delta Gamma Int ACB 3.000 0.04 +0 0.02 0.11 0 1 -0.12 0.15 5 ACB 3.500 0.17 -0.03 0.12 0.18 12 0.89 -0.22 0.25 15 ACB 4.000 0.32 -0.11 0.3 0.36 45 0.82 -0.38 0.36 57 ACB 4.500 0.54 +0 0.58 0.65 0 0.76 -0.57 0.37 197 ACB 5.000 1.17 +0 0.95 1.0200.66 -0.71 0.31 69 ACB 5.500 1.21 +0 1.31 1.5 0 0 -0.79 0.24 3 0.3 8 Determine the following option characteristics from these option expiring on March 4, 2022. (i) The intrinsic and time value of the call option with strike price 5.00. (ii) The intrinsic and time value of the put option with strike price 4.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts