Question: Problem # 3 (8 points) Consider two firms Smith and Jones that are identical except for capital structure. Each firm expects EBIT of $840,000

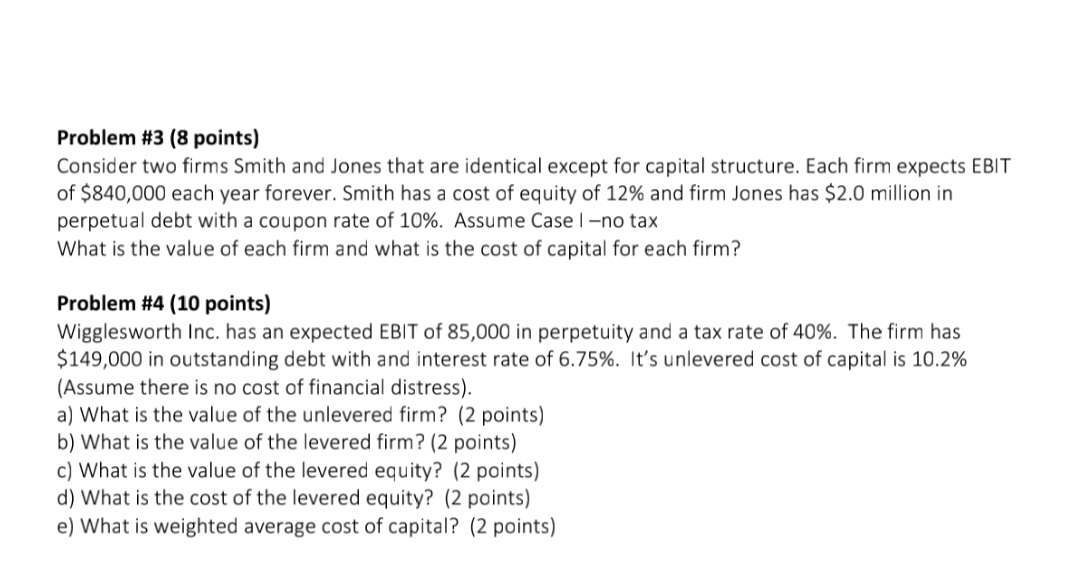

Problem # 3 (8 points) Consider two firms Smith and Jones that are identical except for capital structure. Each firm expects EBIT of $840,000 each year forever. Smith has a cost of equity of 12% and firm Jones has $2.0 million in perpetual debt with a coupon rate of 10%. Assume Case | -no tax What is the value of each firm and what is the cost of capital for each firm? Problem #4 (10 points) Wigglesworth Inc. has an expected EBIT of 85,000 in perpetuity and a tax rate of 40%. The firm has $149,000 in outstanding debt with and interest rate of 6.75%. It's unlevered cost of capital is 10.2% (Assume there is no cost of financial distress). a) What is the value of the unlevered firm? (2 points) b) What is the value of the levered firm? (2 points) c) What is the value of the levered equity? points) d) What is the cost of the levered equity? (2 points) e) What is weighted average cost of capital? (2 points)

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Problem 3 Firm Valuation and Cost of Capital Case I No Taxes 1 Smith All Equity Value Since Smith has no debtits value is simply the capitalized value ... View full answer

Get step-by-step solutions from verified subject matter experts