Question: PROBLEM 3. (8 pts) Consider a one-period model with two risky assets Sl and S2. The prices of S1 and $2 will have the following

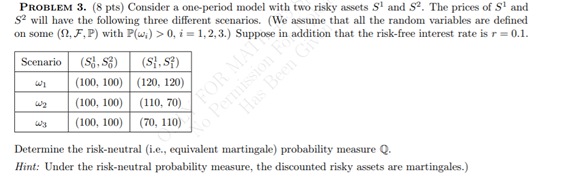

PROBLEM 3. (8 pts) Consider a one-period model with two risky assets Sl and S2. The prices of S1 and $2 will have the following three different scenarios. (We assume that all the random variables are defined on some (12, F,P) with P(wi) > 0, i = 1,2,3.) Suppose in addition that the risk-free interest rate is r=0.1. Scenario (S), 3) (SS) w (100, 100) (120, 120) ws (100, 100) (110, 70) (100, 100) (70, 110) Determine the risk-neutral (i.e., equivalent martingale) probability measure Q. Hint: Under the risk-neutral probability measure, the discounted risky assets are martingales.) POR MAIS Permission Has Been G PROBLEM 3. (8 pts) Consider a one-period model with two risky assets Sl and S2. The prices of S1 and $2 will have the following three different scenarios. (We assume that all the random variables are defined on some (12, F,P) with P(wi) > 0, i = 1,2,3.) Suppose in addition that the risk-free interest rate is r=0.1. Scenario (S), 3) (SS) w (100, 100) (120, 120) ws (100, 100) (110, 70) (100, 100) (70, 110) Determine the risk-neutral (i.e., equivalent martingale) probability measure Q. Hint: Under the risk-neutral probability measure, the discounted risky assets are martingales.) POR MAIS Permission Has Been G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts