Question: PROBLEM 3 (8 pts) - Retirement Planning Daniel recently graduated from Bryant. He is 22 years old and employed. Daniel plans to start putting $18,000

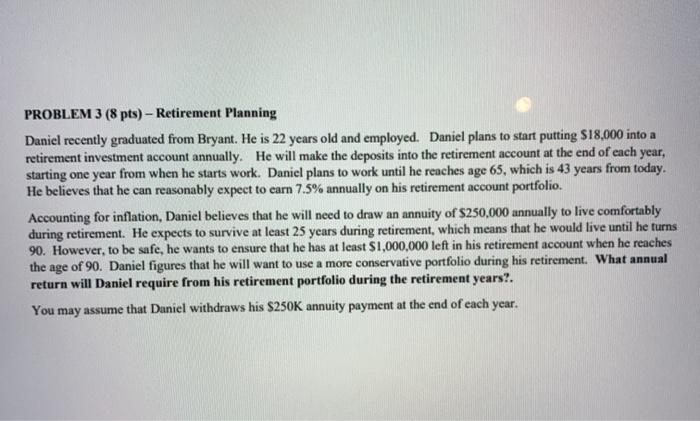

PROBLEM 3 (8 pts) - Retirement Planning Daniel recently graduated from Bryant. He is 22 years old and employed. Daniel plans to start putting $18,000 into a retirement investment account annually. He will make the deposits into the retirement account at the end of each year, starting one year from when he starts work. Daniel plans to work until he reaches age 65, which is 43 years from today. He believes that he can reasonably expect to earn 7.5% annually on his retirement account portfolio. Accounting for inflation, Daniel believes that he will need to draw an annuity of $250,000 annually to live comfortably during retirement. He expects to survive at least 25 years during retirement, which means that he would live until he turns 90. However, to be safe, he wants to ensure that he has at least $1,000,000 left in his retirement account when he reaches the age of 90. Daniel figures that he will want to use a more conservative portfolio during his retirement. What annual return will Daniel require from his retirement portfolio during the retirement years?. You may assume that Daniel withdraws his $250K annuity payment at the end of each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts