Question: Problem 3 (8%) = Suppose that there are two stocks, 1 and 2, whose returns are perfectly negatively correlated. Specifically, the stock returns are given

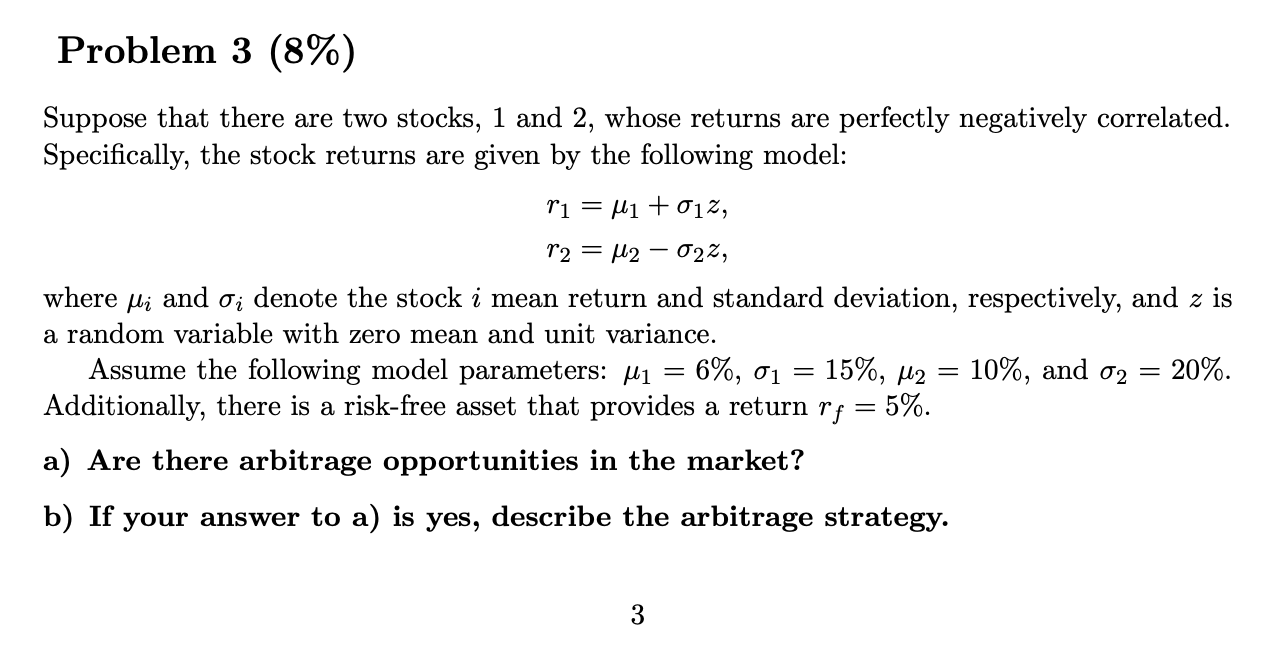

Problem 3 (8%) = Suppose that there are two stocks, 1 and 2, whose returns are perfectly negatively correlated. Specifically, the stock returns are given by the following model: ri = M1 +012, r2 = M2 022, where yi and o denote the stock i mean return and standard deviation, respectively, and z is a random variable with zero mean and unit variance. Assume the following model parameters: Mi = 6%, 01 15%, M2 = 10%, and 02 20%. Additionally, there is a risk-free asset that provides a return rf = 5%. a) Are there age opportunities in the market? b) If your answer to a) is yes, describe the arbitrage strategy. - = 3 Problem 3 (8%) = Suppose that there are two stocks, 1 and 2, whose returns are perfectly negatively correlated. Specifically, the stock returns are given by the following model: ri = M1 +012, r2 = M2 022, where yi and o denote the stock i mean return and standard deviation, respectively, and z is a random variable with zero mean and unit variance. Assume the following model parameters: Mi = 6%, 01 15%, M2 = 10%, and 02 20%. Additionally, there is a risk-free asset that provides a return rf = 5%. a) Are there age opportunities in the market? b) If your answer to a) is yes, describe the arbitrage strategy. - = 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts