Question: Problem #3: . A 12% $100,000 bond is dated and issued on January 1, 2017 and pays interest each June 30 and December 31. The

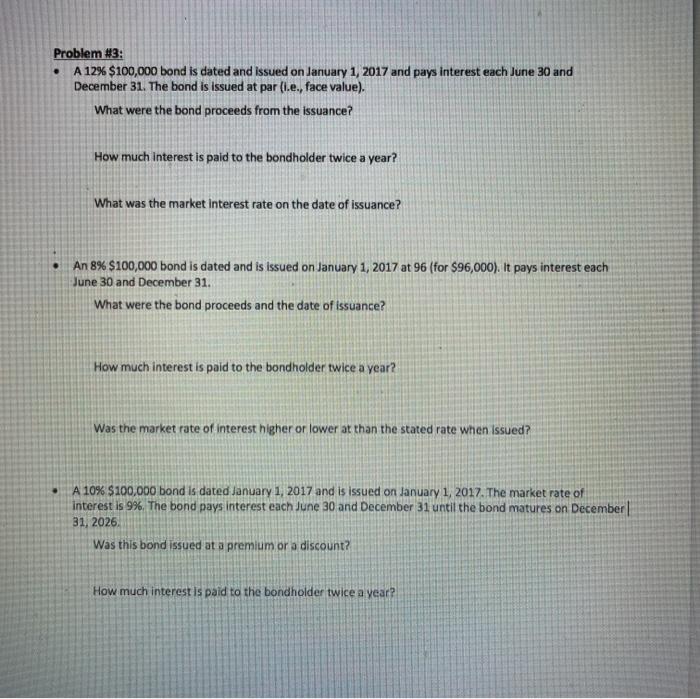

Problem #3: . A 12% $100,000 bond is dated and issued on January 1, 2017 and pays interest each June 30 and December 31. The bond is issued at par(.e., face value). What were the bond proceeds from the issuance? How much interest is paid to the bondholder twice a year? What was the market interest rate on the date of issuance? . An 8% $100,000 bond is dated and is issued on January 1, 2017 at 96 (for $96,000). It pays interest each June 30 and December 31. What were the bond proceeds and the date of issuance? How much interest is paid to the bondholder twice a year? Was the market rate of interest higher or lower at than the stated rate when Issued? A 10% $100,000 bond is dated January 1, 2017 and is issued on January 1, 2017. The market rate of interest is 9%. The bond pays interest each June 30 and December 31 until the bond matures on December 31, 2026 Was this bond issued at a premium or a discount? How much interest is paid to the bondholder twice a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts