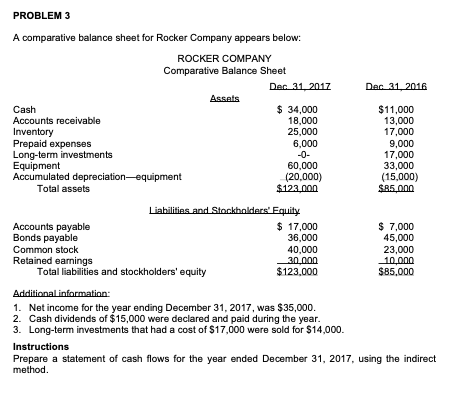

Question: PROBLEM 3 A comparative balance sheet for Rocker Company appears below: ROCKER COMPANY Comparative Balance Sheet Dec 31, 2017 Dec 31, 2016 Assets Cash $

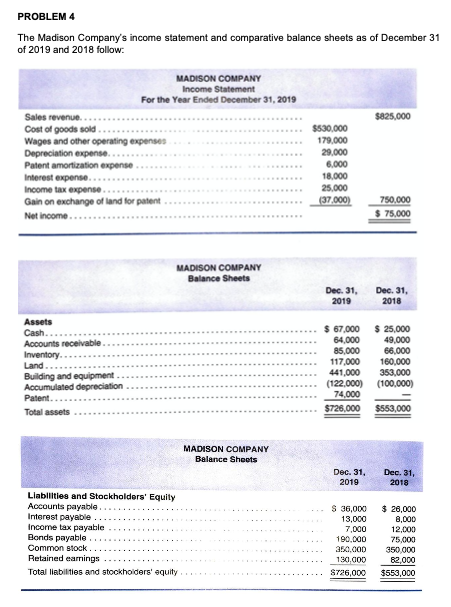

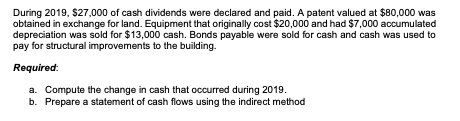

PROBLEM 3 A comparative balance sheet for Rocker Company appears below: ROCKER COMPANY Comparative Balance Sheet Dec 31, 2017 Dec 31, 2016 Assets Cash $ 34,000 $11,000 Accounts receivable 18,000 13,000 Inventory 25,000 17,000 Prepaid expenses 6,000 9,000 Long-term investments 17,000 Equipment 60,000 33,000 Accumulated depreciation-equipment (20.000) (15,000) Total assets $123.000 $.85.000 Liabilities and Stockholders' Equity Accounts payable $ 17,000 $ 7,000 Bonds payable 36,000 45,000 Common stock 40,000 23,000 Retained earnings 30.000 10,000 Total liabilities and stockholders' equity $123.000 $85.000 Additional information: 1. Net income for the year ending December 31, 2017, was $35,000. 2. Cash dividends of $15,000 were declared and paid during the year. 3. Long-term investments that had a cost of $17,000 were sold for $14,000. Instructions Prepare a statement of cash flows for the year ended December 31, 2017, using the indirect method PROBLEM 4 The Madison Company's income statement and comparative balance sheets as of December 31 of 2019 and 2018 follow: $825.000 MADISON COMPANY Income Statement For the Year Ended December 31, 2019 Sales revenue Cost of goods sold Wages and other operating expenses Depreciation expense.. Patent amortization expense Interest expense.. Income tax expense Gain on exchange of land for patent Net income $530,000 179.000 29.000 6.000 18.000 25.000 (37.000) 750,000 $ 75,000 MADISON COMPANY Balance Sheets Dec. 31, 2019 Dec. 31, 2018 Assets Cash.. Accounts receivable Inventory Land.. Building and equipment Accumulated depreciation Patent... Total assets $ 67,000 64,000 85,000 117,000 441,000 (122.000) 74,000 $728.000 $ 25,000 49,000 66,000 160,000 353,000 (100,000) $553,000 MADISON COMPANY Balance Sheets Dec. 31, 2019 Dec. 31, 2018 Liabilities and Stockholders' Equity Accounts payable Interest payable Income tax payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity S 36,000 13,000 7.000 190.000 350.000 130.000 8726,000 $ 20,000 8,000 12,000 75,000 350.000 82,000 $553,000 During 2019, $27,000 of cash dividends were declared and paid. A patent valued at $80,000 was obtained in exchange for land. Equipment that originally cost $20,000 and had $7,000 accumulated depreciation was sold for $13,000 cash. Bonds payable were sold for cash and cash was used to pay for structural improvements to the building. Required: a. Compute the change in cash that occurred during 2019. b. Prepare a statement of cash flows using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts