Question: Problem 3 (a) (i Suppose that the nominal interest rate is 5% per year and the inflation rate is 2%. What is the real interest

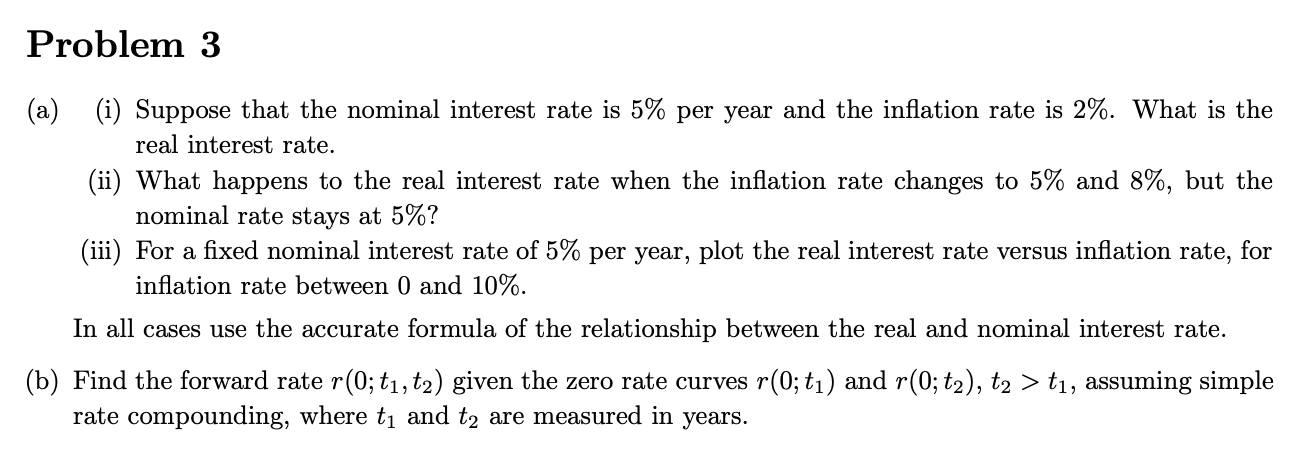

Problem 3 (a) (i Suppose that the nominal interest rate is 5% per year and the inflation rate is 2%. What is the real interest rate. (ii) What happens to the real interest rate when the inflation rate changes to 5% and 8%, but the nominal rate stays at 5%? (iii) For a fixed nominal interest rate of 5% per year, plot the real interest rate versus inflation rate, for inflation rate between 0 and 10%. In all cases use the accurate formula of the relationship between the real and nominal interest rate (b) Find the forward rate r(0; t1,t2) given the zero rate curves r(0; t1) and r(0; t2), t2 > t1, assuming simple rate compounding, where ti and t2 are measured in years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts