Question: Problem 3. A newly issued bond has a face value of $1000, a maturity of 10 years and pays a 5.5% coupon rate with coupon

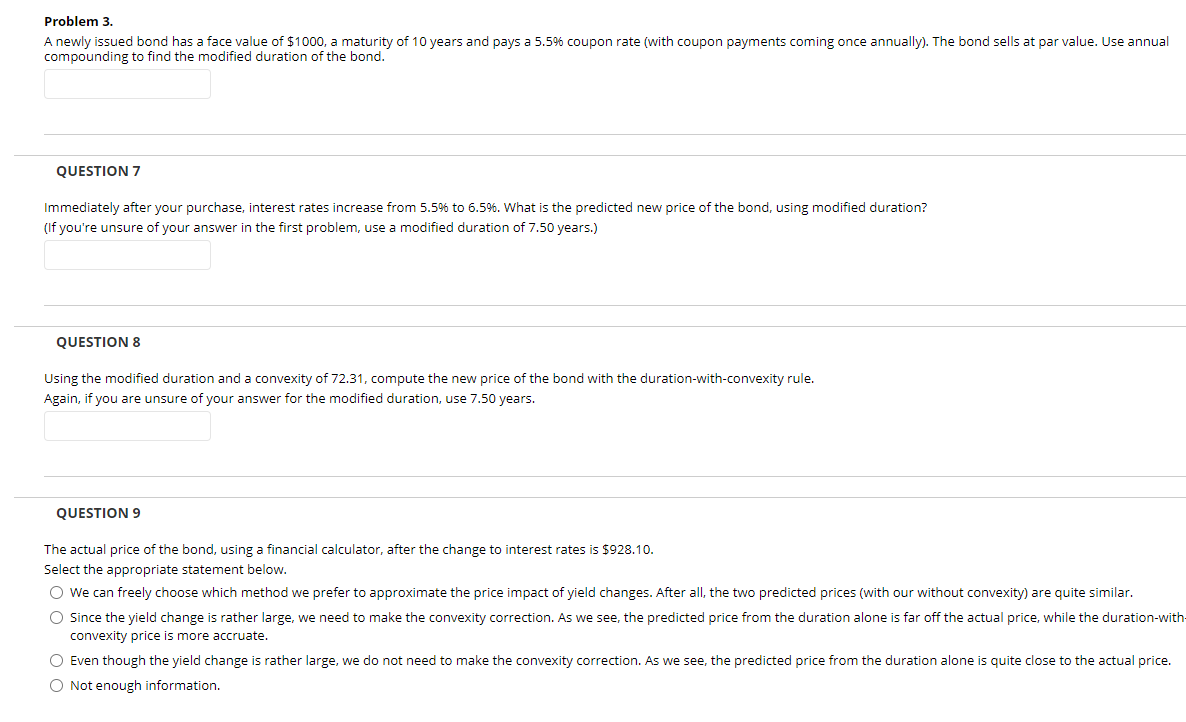

Problem 3. A newly issued bond has a face value of $1000, a maturity of 10 years and pays a 5.5% coupon rate with coupon payments coming once annually). The bond sells at par value. Use annual compounding to find the modified duration of the bond. QUESTION 7 Immediately after your purchase, interest rates increase from 5.5% to 6.5%. What is the predicted new price of the bond, using modified duration? (If you're unsure of your answer in the first problem, use a modified duration of 7.50 years.) QUESTION 8 Using the modified duration and a convexity of 72.31, compute the new price of the bond with the duration-with-convexity rule. Again, if you are unsure of your answer for the modified duration, use 7.50 years. QUESTION 9 The actual price of the bond, using a financial calculator, after the change to interest rates is $928.10. Select the appropriate statement below. We can freely choose which method we prefer to approximate the price impact of yield changes. After all, the two predicted prices (with our without convexity) are quite similar. Since the yield change is rather large, we need to make the convexity correction. As we see, the predicted price from the duration alone is far off the actual price, while the duration-with convexity price is more accruate. Even though the yield change is rather large, we do not need to make the convexity correction. As we see, the predicted price from the duration alone is quite close to the actual price. Not enough information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts