Question: Problem 3 A. On October 1, 2019, Clark, Inc. assigns $500,000 of its accounts receivable to 1st National Bank as collateral for a $350,000 note.

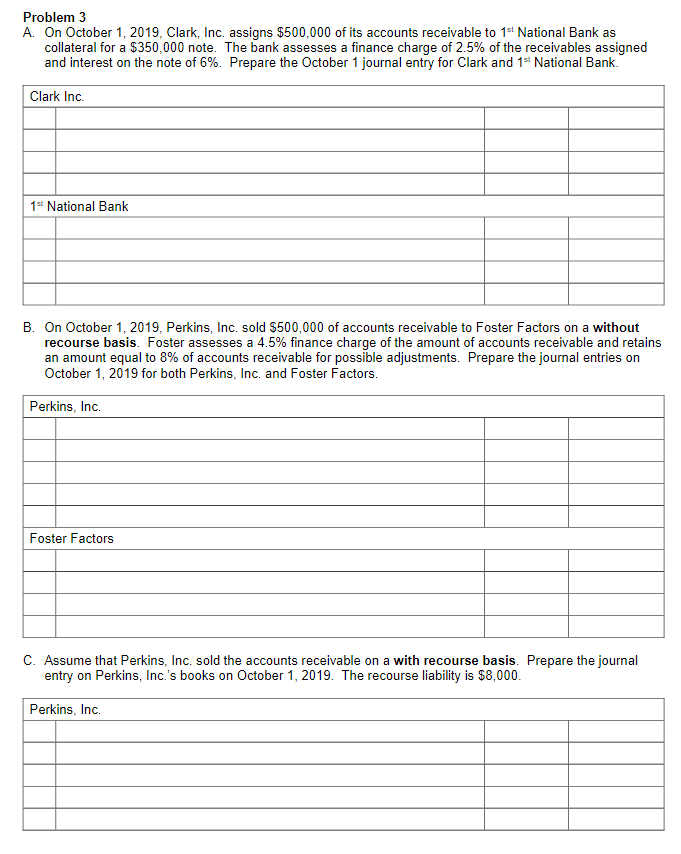

Problem 3 A. On October 1, 2019, Clark, Inc. assigns $500,000 of its accounts receivable to 1st National Bank as collateral for a $350,000 note. The bank assesses a finance charge of 2.5% of the receivables assigned and interest on the note of 6%. Prepare the October 1 journal entry for Clark and 1st National Bank. Clark Inc. 1 National Bank B. On October 1, 2019, Perkins, Inc. sold $500,000 of accounts receivable to Foster Factors on a without recourse basis. Foster assesses a 4.5% finance charge of the amount of accounts receivable and retains an amount equal to 8% of accounts receivable for possible adjustments. Prepare the journal entries on October 1, 2019 for both Perkins, Inc. and Foster Factors. Perkins, Inc. Foster Factors C. Assume that Perkins, Inc. sold the accounts receivable on a with recourse basis. Prepare the journal entry on Perkins, Inc.'s books on October 1, 2019. The recourse liability is $8,000. Perkins, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts