Question: Problem 3 ( A Real Data Application ) , Recalling in the simple linear regression model in Module 3 , I gave a real data

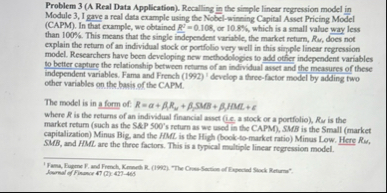

Problem A Real Data Application Recalling in the simple linear regression model in Module I gave a real data example using the Nobelwinning Capital Asset Pricing Model CAPM In that example, we obtained or which is a small value way less than This means that the single independent variable, the market return, Ru does not explain the return of an individual stock or portfolio very well in this sipple linear regression model. Researchers have been developing new methodologies to add offer independent variables to better capture the relationship between returns of an individual asset and the measures of these independent variables. Fama and French develop a threefactor model by adding two other variables on the basis of the CAPM.

The model is in n form of: where is the returns of an individual financial asset ie a stock or a portfolio is the market return such as the SAP s return as we used in the CAPM SMB is the Small market capitalization Minus Big, and the HML is the High booktomarket ratio Minus Low. Here Rw SMB and HML are the three factors. This is a typical multiple linear regression model.

formal eFinanor

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock