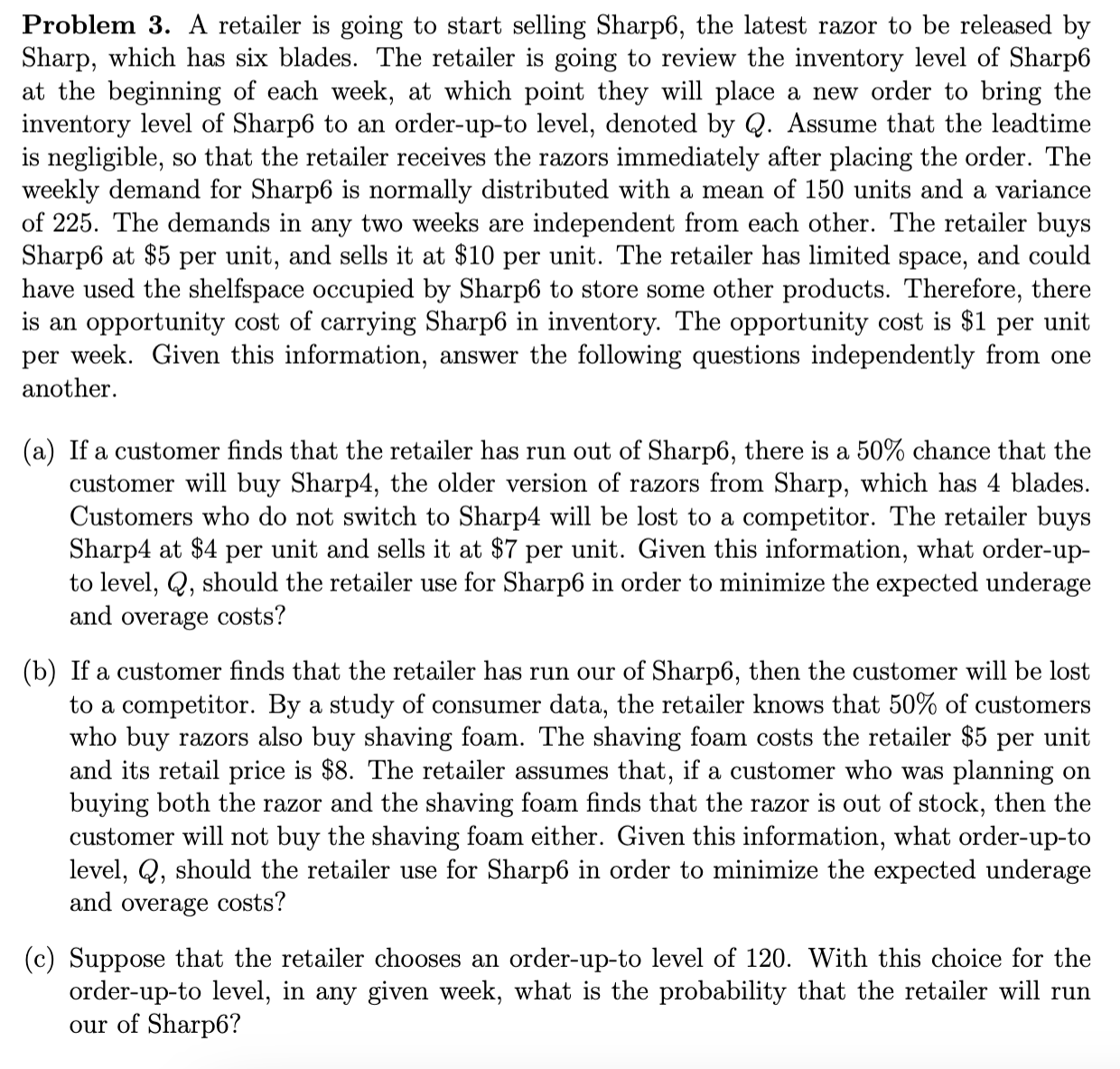

Question: Problem 3 . A retailer is going to start selling Sharp 6 , the latest razor to be released by Sharp, which has six blades.

Problem A retailer is going to start selling Sharp the latest razor to be released by

Sharp, which has six blades. The retailer is going to review the inventory level of Sharp

at the beginning of each week, at which point they will place a new order to bring the

inventory level of Sharp to an orderupto level, denoted by Assume that the leadtime

is negligible, so that the retailer receives the razors immediately after placing the order. The

weekly demand for Sharp is normally distributed with a mean of units and a variance

of The demands in any two weeks are independent from each other. The retailer buys

Sharp at $ per unit, and sells it at $ per unit. The retailer has limited space, and could

have used the shelfspace occupied by Sharp to store some other products. Therefore, there

is an opportunity cost of carrying Sharp in inventory. The opportunity cost is $ per unit

per week. Given this information, answer the following questions independently from one

another.

a If a customer finds that the retailer has run out of Sharp there is a chance that the

customer will buy Sharp the older version of razors from Sharp, which has blades.

Customers who do not switch to Sharp will be lost to a competitor. The retailer buys

Sharp at $ per unit and sells it at $ per unit. Given this information, what orderup

to level, should the retailer use for Sharp in order to minimize the expected underage

and overage costs?

b If a customer finds that the retailer has run our of Sharp then the customer will be lost

to a competitor. By a study of consumer data, the retailer knows that of customers

who buy razors also buy shaving foam. The shaving foam costs the retailer $ per unit

and its retail price is $ The retailer assumes that, if a customer who was planning on

buying both the razor and the shaving foam finds that the razor is out of stock, then the

customer will not buy the shaving foam either. Given this information, what orderupto

level, should the retailer use for Sharp in order to minimize the expected underage

and overage costs?

c Suppose that the retailer chooses an orderupto level of With this choice for the

orderupto level, in any given week, what is the probability that the retailer will run

our of Sharp

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock