Question: Problem 3: Activity-Based Costing (20 points) University Student Cleanup provides housecleaning services to its clients (primarily university students). During its first year, USC had a

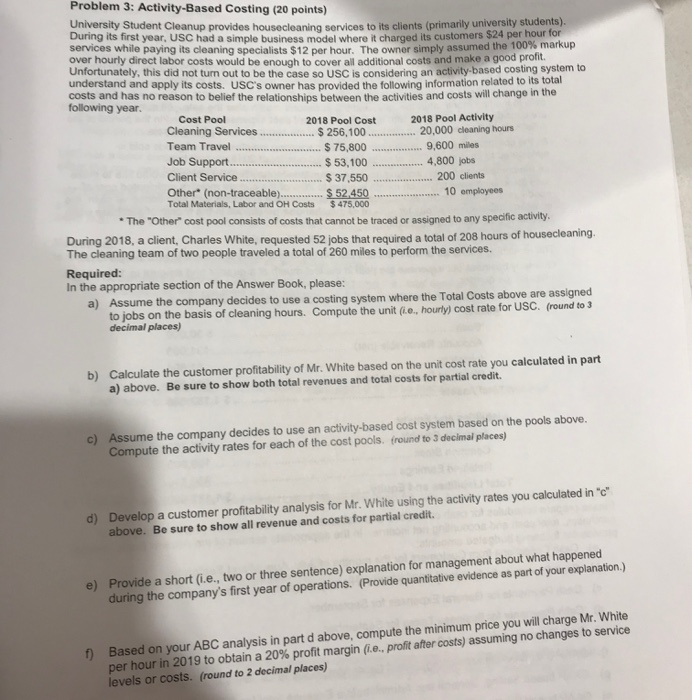

Problem 3: Activity-Based Costing (20 points) University Student Cleanup provides housecleaning services to its clients (primarily university students). During its first year, USC had a simple business model where it charged its customers $24 per hour for services while paying its cleaning specialists $12 per hour. The owner simply assumed the 100% markup over hourly direct labor costs would be enough to cover all additional costs and make a good profit. Unfortunately, this did not tum out to be the case so USC is considering an activity-based costing system to understand and apply its costs. USC's owner has provided the following information related to its total costs and has no reason to belief the relationships between the activities and costs will change in the following year. 2018 Pool Activity 20,000 cleaning hours Cost Pool 2018 Pool Cost Cleaning Services $ 256,100. 9,600 miles 4,800 jobs 200 clients 10 employees Team Travel $ 75,800 www Job Support... Client Service. Other (non-traceable).. $53,100 $ 37.550 $52,450 $475,000 Total Materials, Labor and OH Costs The "Other" cost pool consists of costs that cannot be traced or assigned to any specific activity. During 2018, a client, Charles White, requested 52 jobs that required a total of 208 hours of housecleaning. The cleaning team of two people traveled a total of 260 miles to perform the services. Required: In the appropriate section of the Answer Book, please: a) Assume the company decides to use a costing system where the Total Costs above are assigned to jobs on the basis of cleaning hours. Compute the unit (ie., hourly) cost rate for USC. (round to 3 decimal places) b) Calculate the customer profitability of Mr. White based on the unit cost rate you calculated in part a) above. Be sure to show both total revenues and total costs for partial credit. c) Assume the company decides to use an activity-based cost system based on the pools above. Compute the activity rates for each of the cost pools. (round to 3 decimal places) d) Develop a customer profitability analysis for Mr. White using the activity rates you calculated in "c above. Be sure to show all revenue and costs for partial credit. e) Provide a short (i.e., two or three sentence) explanation for management about what happened during the company's first year of operations. (Provide quantitative evidence as part of your explanation.) )Based on your ABC analysis in part d above, compute the minimum price you will charge Mr. White per hour in 2019 to obtain a 20% profit margin (i.e., profit after costs) assuming no changes to service levels or costs. (round to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts